- Asset Name: Turning point for profitable resales as gains start to fall

- Overview Text: The resale performance of residential real estate has reached a turning point, CoreLogic NZ’s latest Pain & Gain report shows, with Q2 figures revealing that the post-COVID run has lost steam.

- Image:

- Asset Name: Latest OCR rise may not hit mortgage rates

- Overview Text: As expected the Reserve Bank (RBNZ) delivered another 0.5% increase in the official cash rate (OCR) today, taking it to 3% – the highest level since September 2015 (when it was lowered from 3% to 2.75%).

- Image:

- Asset Name: Has there been a clear effect on property values from Transmission Gully?

- Overview Text:

- Image:

- Asset Name: Hope for housing affordability as property prices fall

- Overview Text: New Zealand’s housing affordability is slowly showing signs of improvement, on the back of falling house prices and a gradual increase in incomes, according to CoreLogic’s bi-annual Housing Affordability Report.

- Image:

- Asset Name: One-year fixed mortgage rates of 7% or more on the cards

- Overview Text: Given the evidence that inflation is proving tougher to stamp out than was previously expected, it doesn’t come as much surprise the Reserve Bank of New Zealand (RBNZ) opted for a ‘jumbo’ 0.75% increase in the official cash rate (OCR) today, lifting it to 4.25%.

- Image:

- Asset Name: High mortgage rates and recession – a bad combination for property

- Overview Text: The RBNZ’s final Monetary Policy Statement (MPS) for 2022 surprised many due to their indication the country’s economic outlook is worse than previously anticipated. The RBNZ now firmly expects a mild recession in 2023, which is ‘required’ to start to bring inflation down from the second half of 2023. Kelvin Davidson explores what else the MPS outlined, the implications for the property market, and what we should be watching for next.

- Image:

- Asset Name: A single source of truth to help energy retailers overcome addressing challenges

- Overview Text: CoreLogic’s addressing provides a crucial link between energy distributors and retailers, helping save time and money and create a seamless customer experience.

- Image:

- Asset Name: Conditions are starting to shift in favour of ‘trading up’

- Overview Text: In areas such as Auckland City, Waitakere, Manukau, Wellington City and Dunedin, the gap in median values between three- and four-bedroom properties, or the 'trading up gap', has started to drop.

- Image:

- Asset Name: 5 Ways Comprehensive Property Data Helps Inform Lending Strategies

- Overview Text: In today’s competitive landscape, preliminary data sets are not enough. Lenders need a holistic view of New Zealand’s mortgage market, to properly assess market share, peer-to-peer comparisons and geographical breakdown of vital buying and selling data.

- Image:

- Asset Name: Property values plunge in more than 80% of New Zealand suburbs

- Overview Text: CoreLogic NZ’s interactive Mapping the Market tool, updated quarterly, provides insight into how the value of property varies across cities, across the country, as well as how values have shifted over time.

- Image:

- Asset Name: First home buyers quietly returning to the market

- Overview Text: First home buyers (FHBs) accounted for 25% of property purchases in August, their highest market share since December last year.

- Image:

- Asset Name: New mortgage lending activity still very quiet

- Overview Text: Gross mortgage lending flows remained soft in August, with low-deposit finance hard to secure – just 0.7% of investors got such a loan last month (excluding new-builds), and 4.1% for owner-occupiers. A cautious attitude towards low equity loans isn’t hard to understand in an environment where property values are still falling. More generally, after a period where mortgage rates showed signs of a peak, the renewed increases in the past week or so will remain testing for new borrowers, and those rolling off older fixed loans.

- Image:

- Asset Name: House Price Index shows rate of decline in housing values eases in September, but downturn has further to run

- Overview Text: The housing market downturn in Aotearoa NZ retained its negative momentum in September, with values falling by a further -1.5% over the month, easing slightly from the -1.8% fall in August.

- Image:

- Asset Name: One year of OCR increases, with more to come

- Overview Text: The Reserve Bank of NZ delivered another widely anticipated 0.5% increase in the official cash rate (OCR) today, taking it to 3.5% – the highest level since June 2015 when they lowered it from 3.5% to 3.25%.

- Image:

- Asset Name: Construction costs continue to rise, but peak growth may be nearing

- Overview Text: CoreLogic NZ’s Cordell Construction Cost Index (CCCI) for Q3 2022 showed further acceleration in the rate of indexed growth in national residential construction costs, with both the quarterly and annual measures surpassing the previous records set just last quarter.

- Image:

- Asset Name: Property downturn deepens, but important differences remain to GFC

- Overview Text: Decade-low sales volumes and fast-falling home values have deepened the housing market decline however some key dissimilarities between the GFC-induced downturn and today’s exist, CoreLogic NZ’s Q3 Property Market & Economic Update reveals.

- Image:

- Asset Name: Almost a third of New Zealand homeowners not confident their property is adequately insured

- Overview Text: A new survey commissioned by independent property data and analytics provider CoreLogic NZ is giving detailed insight into Aotearoa’s established problem of home underinsurance amid high construction cost inflation, rising insurance premiums, and wider cost of living pressures.

- Image:

- Asset Name: CoreLogic House Price Index shows housing values continue to fall in October

- Overview Text: The housing market downturn in Aotearoa NZ slightly eased in October, with values falling by -1.3% over the month after tracking down -1.5% in September.

- Image:

- Asset Name: NZ first home buyers find silver lining amid housing downturn

- Overview Text: Despite buying activity among New Zealand first home buyers (FHBs) falling to its lowest level since 2011, market newcomers have shown remarkable resilience compared to other buyer groups.

- Image:

- Asset Name: Resale performance still solid, but weakening trend is clear

- Overview Text: The resale performance of residential real estate has continued to deteriorate, as the wider property downturn affects the ability of vendors to sell above their purchase price, CoreLogic NZ’s latest Pain & Gain report shows.

- Image:

- Asset Name: New Zealand rate cuts and house price falls canary in the coal mine

- Overview Text: New Zealand has provided Australia’s property experts with a test case this year, following the central bank’s decision to move early with rate rises in an effort to combat rising inflation and a runaway housing market.

- Image:

- Asset Name: House Price Index shows NZ housing downturn deepens – rate of fall comparable to depths of GFC

- Overview Text: New Zealand’s housing market downturn has accelerated in the past month with the rate of falls in property values doubling month-on-month in August. CoreLogic’s House Price Index (HPI) shows the national measure of property values fell a further -1.8% in August, twice the rate of that seen in July (-0.9%).

- Image:

- Asset Name: CoreLogic HPI: Wellington remains at ‘epicentre’ of downturn as value declines moderate elsewhere

- Overview Text: Aotearoa New Zealand’s housing market downturn continued to ease in the past month, with the rate of decline in national property values halving month-on-month in November.

- Image:

- Asset Name: Tough conditions for new investment purchases

- Overview Text: Mortgaged multiple property owners (MPOs, including investors) have been in the firing line lately, as Government/Reserve Bank regulation has ramped up, and the simple economics of being a landlord have also turned against them.

- Image:

- Asset Name: CoreLogic HPI: Decreasing rate of NZ house price falls probably a false dawn

- Overview Text: CoreLogic’s House Price Index (HPI) shows property values fell -0.2% in December, a further reduction in the pace of price declines from previous months (-0.6% in November and -1.3% in October).

- Image:

- Asset Name: Annual construction cost growth hits a record high as industry slowdown looms

- Overview Text: A nascent drop off in the number of new housing consents could soon help to ease the pressure on New Zealand’s residential construction sector, which has dealt with rapidly rising costs for more than 12 months.

- Image:

- Asset Name: Opinion: New Zealand LVRs not likely to be loosened this year

- Overview Text: Early this year I was quoted in an article that explored how the country’s housing market might change if the current ‘artificial’ restrictions were taken off. It was a purely hypothetical scenario musing over the removal of the many handbrakes introduced in recent years including the Foreign Buyer Ban and loan-to-value ratio (LVR) rules.

- Image:

- Asset Name: Too soon to conclude an imminent end to the property market downturn

- Overview Text: CoreLogic NZ’s Q4 Property Market & Economic Update shows the quarterly drop in home values was the smallest decline since May 2022 (-0.9%), on the back of the monthly national fall easing to -0.2% in December.

- Image:

- Asset Name: New Zealand's Q4 CPI figure steady, but still high

- Overview Text: Today’s Stats NZ figures showed that inflation on the consumer price index (CPI) was unchanged in Q4, remaining at 7.2%. Categories such as food, rent, and building a new house were key contributors to the Q4 inflation figure.

- Image:

- Asset Name: No reprieve for persistent property price falls

- Overview Text: Aotearoa New Zealand’s housing market downturn continues to roll on, with CoreLogic’s House Price Index (HPI) recording a 0.3% fall in January, the 10th consecutive month of decline.

- Image:

- Asset Name: We may not see a property investor comeback for a while yet

- Overview Text: There’s been an increasing number of hurdles placed in front of property investors in the past couple of years. With weaker market conditions I thought it was a good time to check in on the fundamentals to see whether it will be enough for property investors to jump back into action.

- Image:

- Asset Name: How Agents are using data to navigate a challenging market

- Overview Text: Since the peak for property values in March 2022 the real estate market across New Zealand has grown increasingly more challenging for real estate agents who have been faced with longer sales periods and reduced buyer confidence due to increasing interest rates.

- Image:

- Asset Name: More homes selling at a loss as interest rates bite

- Overview Text: More people are losing money on the resale of their properties than they have been at any time in the past three years.

- Image:

- Asset Name: Interest rate hikes wipe out housing affordability gains

- Overview Text: Housing has become more affordable on some measures, but due to continued rate rises, mortgage repayments are still eating up a big chunk of people’s income, according to the latest CoreLogic Housing Affordability Report.

- Image:

- Asset Name: Reserve Bank stick to their guns in fight against inflation

- Overview Text: Given the (slowly) emerging evidence that inflation has peaked and that the economy is now starting to soften, it wasn’t a surprise to see the Reserve Bank opt for ‘only’ a 0.5% rise in the official cash rate (OCR) today, rather than the potential 0.75% increase.

- Image:

- Asset Name: CoreLogic boosts its proptech powers with acquisition of digital real estate marketing firm Plezzel

- Overview Text: CoreLogic International has completed its acquisition of Victorian-based proptech firm Plezzel, helping to expand its real estate industry technology solutions.

- Image:

- Asset Name: CoreLogic HPI shows housing downturn gathers steam again in February

- Overview Text: The downturn in New Zealand’s property market reaccelerated last month, with values falling 1% in February, according to the CoreLogic House Price Index.

- Image:

- Asset Name: New Vulnerability Index reveals New Zealand's regions most at risk of a property downturn, and why

- Overview Text:

- Image:

- Asset Name: The NZ homeowners hit hardest by the property price slump

- Overview Text:

- Image:

- Asset Name: Nine out of 10 properties still selling for a profit

- Overview Text: A turnaround in wider housing market conditions has led the portion of profitable property resales to almost stablise in Q3, after falling by almost seven percentage points in less than two years.

- Image:

- Asset Name: Monthly Housing Chart Pack - August 2023

- Overview Text: Each month the CoreLogic Research team puts together a Housing Chart Pack, with all the latest stats, facts and figures on the residential property market, such as the combined value of residential real estate, sales and listings, buyer classification, rents, credit conditions and more.

- Image:

- Asset Name: CoreLogic and Pepper Money sign five-year trans-Tasman partnership

- Overview Text: CoreLogic and award-winning non-bank lender Pepper Money have signed a five-year strategic partnership across New Zealand and Australia.

- Image:

- Asset Name: Cordell Sum Sure keeping pace with changing conditions

- Overview Text: CoreLogic’s Cordell Sum Sure is not set and forget, but it regularly updated to identify the true cost of rebuilding should the worst happen

- Image:

- Asset Name: CoreLogic House Price Index shows values weak ahead of OCR decision

- Overview Text: The downturn in New Zealand’s property market continued in March, with average values down another 1.1%, according to the CoreLogic House Price Index.

- Image:

- Asset Name: Reserve Bank still taking a tough inflationary stance

- Overview Text: Today’s 0.5% increase to the official cash rate (OCR) was larger than many commentators (myself included) had been anticipating, but it reflects the Reserve Bank’s (RBNZ) continued concerns about inflation.

- Image:

- Asset Name: Cost to build shows signs of slowing as construction material crisis eases

- Overview Text: The latest Cordell Construction Cost Index (CCCI) shows construction costs rose 0.6% in the March quarter, well below the average quarterly increases of 2% recorded in 2021 and 2022.

- Image:

- Asset Name: Using data to shorten response time during a natural disaster

- Overview Text: Discover how lenders and government leveraged CoreLogic data and satellite imagery during the recent weather emergencies, and how we can help organisations plan for, and respond to, future weather events.

- Image:

- Asset Name: Is this the beginning of the end for the NZ house price downturn?

- Overview Text:

- Image:

- Asset Name: CoreLogic NZ launches powerful new property market insights product

- Overview Text: CoreLogic NZ has unveiled a new property market insights product that provides extensive insights into the country's residential housing landscape using detailed and comprehensive data sources.

- Image:

- Asset Name: What property investors need to know about NZ’s debt-to-income ratios

- Overview Text: Chief Property Economist Kelvin Davidson explains how incoming debt-to-income ratios could impact property investors.

- Image:

- Asset Name: House prices still falling, but at a slower rate

- Overview Text: The downturn in New Zealand’s property market continued in April, with average values down by another 0.6%, CoreLogic’s monthly House Price Index (HPI) shows.

- Image:

- Asset Name: First home buyers holding on with 25% market share despite low sales activity

- Overview Text: Despite continued affordability pressures, tight lending rules and higher mortgage rates, first home buyers (FHBs) in Aotearoa New Zealand have maintained their record high market share over the past two quarters.

- Image:

- Asset Name: Housing headwinds hit mortgaged investors as market share slumps to historic low

- Overview Text: Low yields, high mortgage rates, high deposits and interest deductibility changes are deterring mortgaged multiple property owners (MPOs), with the buyer group’s share of property purchases shrinking to a new record low of 19.9% in April.

- Image:

- Asset Name: Property resale losses at seven-year high

- Overview Text: Continued falls in New Zealand home values have led to the highest portion of properties being resold for a gross loss since 2016.

- Image:

- Asset Name: Drive smarter property decisions with rich Market Trends data

- Overview Text:

- Image:

- Asset Name: OCR on hold for the first time since August 2021

- Overview Text: Today’s decision from the Reserve Bank of New Zealand (RBNZ) to leave the official cash rate (OCR) unchanged at 5.5% will have surprised very few people.

- Image:

- Asset Name: RBNZ stays the course, OCR up to 5.5%

- Overview Text: Today’s 0.25% increase to the official cash rate (OCR) was fully in line with expectations, given inflation itself slowed in Q1 this year.

- Image:

- Asset Name: Reserve Bank is still in ‘wait and see’ mode

- Overview Text: Kelvin Davidson outlines what today's cash rate decision means.

- Image:

- Asset Name: Experience the power of NZ’s most comprehensive geospatial data

- Overview Text: Dig deep into CoreLogic’s market-leading geospatial data with the interactive NZ MasterMap portal.

- Image:

- Asset Name: NZ property resale gains fall to lowest level since 2015

- Overview Text: The frequency of NZ property owners reselling for a profit has fallen again, as the country’s housing market downturn flows through to softer resale results.

- Image:

- Asset Name: Final stages for NZ property downturn as house prices start to rise in key areas

- Overview Text: Falls in national property values continued to moderate in July, and with the latest data showing increases in some parts of the country, it all but confirms that the downturn is in its final stages.

- Image:

- Asset Name: When will movers return to the market?

- Overview Text: Relocating owner-occupiers, or ‘movers’, have been relatively inactive over the past year or so, with upsizing, downsizing, and ‘new to area’ moves all drifting lower.

- Image:

- Asset Name: Rising property sales start to bite into NZ’s stock levels

- Overview Text: Buyers are returning to the market with an increase in sales eating into the country’s listings levels, and expected to place a degree of upwards pressure on property prices in the coming months.

- Image:

- Asset Name: NZ’s cost of residential construction eases as dwelling consents decline

- Overview Text: The decline in dwelling consents has alleviated pressure on New Zealand's residential construction sector, leading to a slowdown in building activities and price growth.

- Image:

- Asset Name: Downward property market momentum remains, but for how long?

- Overview Text: Property values across Aotearoa NZ continued to fall in May, down 0.7%, but the annual rate of change has eased, providing tentative evidence the current downturn is winding up.

- Image:

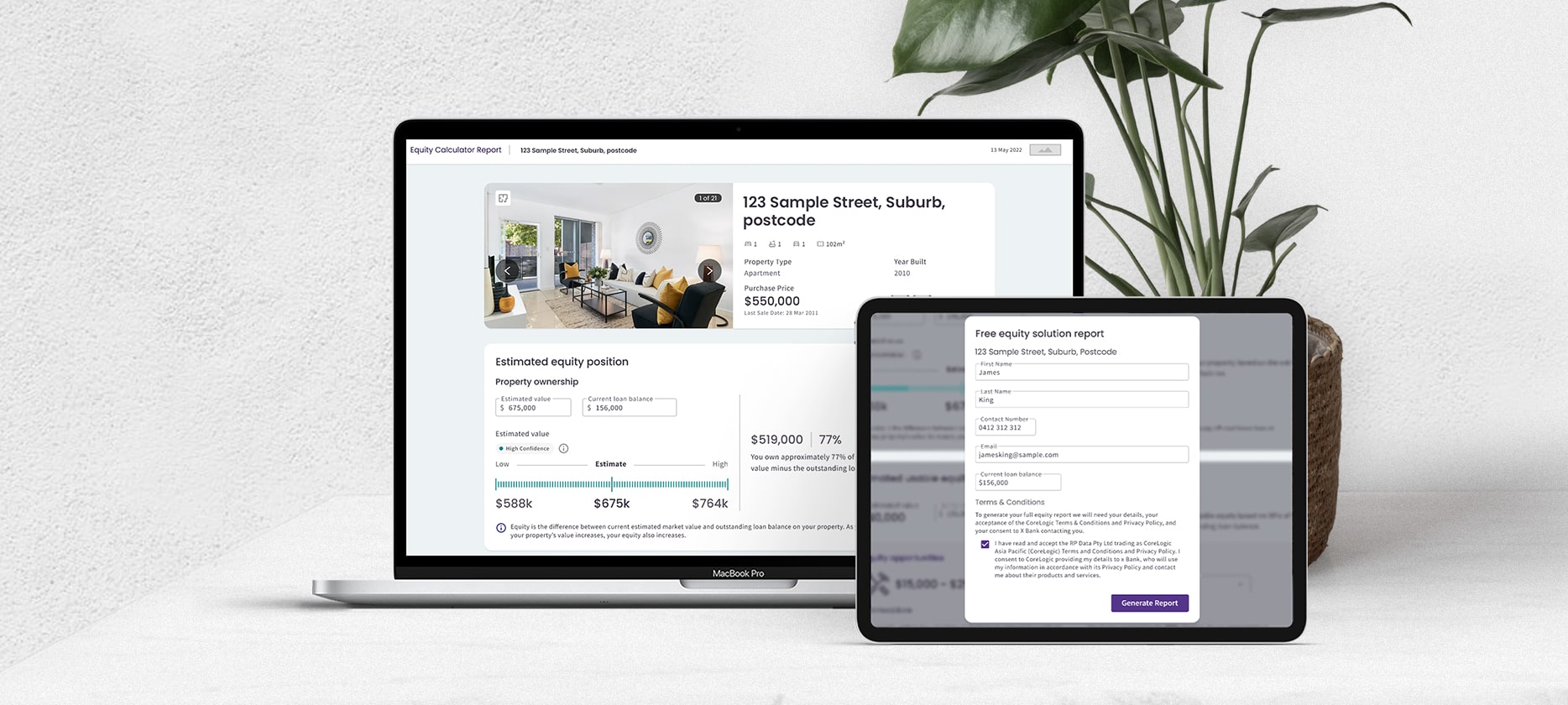

- Asset Name: How to engage homeowners keen to understand their equity

- Overview Text: The new Equity Calculator is joining CoreLogic’s suite of innovative customer engagement tools to help lenders generate leads and create opportunities for growth.

- Image:

- Asset Name: Downswing still in motion, as NZ property price falls accelerate in June

- Overview Text: The market’s downswing continues to roll on, albeit unpredictably, as property values across Aotearoa NZ weakened in June with the monthly rate of decline accelerating, down 1.2% compared to the 0.7% fall in May.

- Image:

- Asset Name: Trade-up premium falls creating opportunity for upsizers

- Overview Text: The continued downturn in property values over the past year has seen the gap in median values between three and four-bedroom homes shrink in most parts of the country. Kelvin Davidson explores the ‘trade-up premium’ and where you may be able to upsize for less than last year.

- Image:

- Asset Name: Home sales record first annual increase in two years

- Overview Text: Property transaction volumes have turned a corner, after consecutive interest rate hikes and tighter lending rules caused two years of softer sales and triggered New Zealand’s largest sales slump since 1983.

- Image:

- Asset Name: NZ recession confirmed but what does it mean for the property market?

- Overview Text: The country’s Q1 GDP figures confirmed what many suspected, NZ was in a recession at the start of the year. Kelvin Davidson explains what this means for the property market.

- Image:

- Asset Name: Yields or capital growth; which investor type are you?

- Overview Text: There are two primary objectives for investors to weigh up when it comes to investing in real estate; yields or capital growth.

- Image:

- Asset Name: Five things to know about the 'refinancing wave'

- Overview Text:

- Image:

- Asset Name: Soft start to 2024 extends into February

- Overview Text: National home values rose 0.3% in February, continuing the decelerating trend seen since December, CoreLogic's House Price Index shows.

- Image:

- Asset Name: Pay gap a challenge for NZ’s female property investors

- Overview Text: Female-only real estate investors significantly lag their male counterparts in fast-tracking wealth creation through property, an analysis of New Zealand’s home ownership reveals.

- Image:

- Asset Name: New Zealand rents surge 6.1% in the past year

- Overview Text: Rental growth is running at historically high levels, hitting 6.1% in the year to October, roughly double the long-term average growth rate of 3.2%, CoreLogic NZ’s Monthly Housing Chart Pack shows.

- Image:

- Asset Name: Property prices rise in 30% of NZ suburbs since June

- Overview Text: Signs of a turning point in Aotearoa New Zealand’s property market are on the rise as a growing number of suburbs record an increase in home values over the past three months.

- Image:

- Asset Name: Rising sales and low new listings will tighten buyer choice

- Overview Text: As property transactions continue to rise against a backdrop of still-low new listings hitting the market, sellers may slowly gain an upper hand as available stock shrinks to the lowest levels in over a year in most markets.

- Image:

- Asset Name: Mortgage lending flows rise for the first time since 2021

- Overview Text: In today's Market Pulse, Chief Property Economist Kelvin Davidson analyses the latest mortgage lending data and what it indicates for the housing market.

- Image:

- Asset Name: National property values flatten as Auckland starts to grow again

- Overview Text: Property values across Aotearoa New Zealand flat-lined in September, most likely ending the 17-month downturn, the CoreLogic House Price Index (HPI) shows.

- Image:

- Asset Name: No OCR rise today, but future odds still seem finely balanced

- Overview Text: Chief Property Economist Kelvin Davidson outlines what today's cash rate decision means.

- Image:

- Asset Name: Latest enhancements to Property Guru

- Overview Text:

- Image:

- Asset Name: Construction enters subdued period as annual cost growth drops to 3.4%

- Overview Text: The New Zealand residential construction industry continues to soften due to a decline in new building consents and workloads, further easing cost pressures.

- Image:

- Asset Name: A Lead Gen Success Story: One Call Session That Funded a Year of Prospecting

- Overview Text: "In one Lead Sourcing call session, Danelle Wiseman from Century21 Caloundra achieved unprecedented results: “One session working with Lead Sourcing resulted in 13 appraisals."

- Image:

- Asset Name: First home buyers climb property ladder with record-high purchases

- Overview Text: While the General Election results are set to draw a ‘line in the sand’ for investors, first home buyers (FHBs) continue to lead the market with nearly 28% of property purchases in September, a record-high.

- Image:

- Asset Name: Unlocking Real Estate Success: Using SMS to overcome contact disengagement

- Overview Text: Did you know that 97.5% of contacts in agency CRMs haven’t had a connected phone call in the last 12 months?*That means there is a wealth of potential vendors already existing in your CRM which haven’t been tapped in to. With time constraints and being constantly on the move, it is challenging to stay connected with clients, which in turn can hinder your prospecting efforts and result in missed opportunities. But what if there was a solution?

- Image:

- Asset Name: Boosting fixed income: How agents are growing their rent roll with new property management leads

- Overview Text: With the market fluctuations seen across the industry over the last year, more agencies are turning their attention to their Property Management teams, securing stable revenue to help support business operations and growth.

- Image:

- Asset Name: ‘Mums and Dads’ set for a come back?

- Overview Text: In today's Market Pulse, Chief Property Economist Kelvin Davidson analyses the shift in investor's property purchasing activity.

- Image:

- Asset Name: House prices begin to rise, but recovery set to remain slow

- Overview Text: After remaining flat in September, CoreLogic’s national House Price Index (HPI) posted the first rise in property values since March 2022, up 0.4% in October and 0.1% higher over the past three months.

- Image:

- Asset Name: First home buyers hit record high 27% market share

- Overview Text: Despite stretched affordability, high interest rates, and cost of living pressures, first home buyers (FHBs) in New Zealand continue to lead the market in purchasing activity, highlighting the continued strong appeal of having a 'foot on the ladder'.

- Image:

- Asset Name: Modest drop in national property values ‘hides’ emerging gains in key sub-markets

- Overview Text:

- Image:

- Asset Name: Kiwis still spending half of household income on mortgage repayments

- Overview Text: Housing affordability in Aotearoa New Zealand has generally been improving as property values fall, incomes rise and interest rates stabilise, however mortgage repayments are still eating up a large proportion of people’s income.

- Image:

- Asset Name: First home buyer market share sets new record

- Overview Text: Interest rate hikes and turbulent property market conditions through 2023 did little to deter first home buyers (FHB), whose market share hit a new record high at 27% in the final months of the year.

- Image:

- Asset Name: Three things to know about a National government and property investors

- Overview Text: This Pulse takes a look at some of the issues surrounding potential housing/tax policy changes for investors if a National government is elected.

- Image:

- Asset Name: Property sale volumes remain erratic

- Overview Text: High mortgage rates continue to pressure the housing market, contributing to patchy volumes month to month, and January sales activity reaching its second lowest level in about 40 years, according to CoreLogic's February Housing Chart Pack.

- Image:

- Asset Name: Kiwi households face ongoing affordability squeeze

- Overview Text: Housing affordability has improved in NZ since late 2021, but it remains stretched, and recent house price rises as well as high interest rates continue to add strain on Kiwi households, according to the latest CoreLogic Housing Affordability Report.

- Image:

- Asset Name: Profitable resales rise for the first time in two years

- Overview Text: The turnaround in the New Zealand housing market has led to the first rise in profitable resales in two years, CoreLogic’s Q4 2023 Pain & Gain Report shows.

- Image:

- Asset Name: Partnering with Pepper Money to improve the valuation experience

- Overview Text:

- Image:

- Asset Name: Property values rise 0.4% to kick off 2024

- Overview Text: The CoreLogic House Price Index rose for the fourth month in a row in January, although the 0.4% increase was a deceleration in the pace of gains on both November (0.7%) and December (1.0%).

- Image:

- Asset Name: Property market signs off 2023 on a strong note

- Overview Text: The CoreLogic House Price Index showed the third consecutive rise in average property values in December, with momentum building.

- Image:

- Asset Name: Supporting Pepper Money in streamlining mortgage origination

- Overview Text: Pepper Money's vision is to help more Kiwis achieve their home ownership goals. To do this, they leverage CoreLogic’s innovative digital mortgage solutions, helping them make fast, confident lending decisions, and provide a smooth and stress-free experience for their advisers and customers.

- Image: