Overview

Use CoreLogic’s solutions to help you improve the insurance experience and build client loyalty, while you manage risk across your portfolio.

You can also assess properties to get comprehensively calculated cost estimates for rebuilds, so you can provide effective cover for every client at the right price.

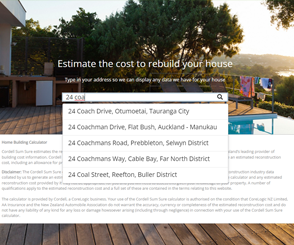

Estimate material costs down to the last nail

Construction costs evolve as technology matures and building methods change. With CoreLogic’s market-leading Cordell database, you gain access to New Zealand's most extensive and up-to-date construction costing data – so you can estimate rebuild costs for residential properties nationwide.

Estimate material costs down to the last nail

Construction costs evolve as technology matures and building methods change. With CoreLogic’s market-leading Cordell database, you gain access to New Zealand's most extensive and up-to-date construction costing data – so you can estimate rebuild costs for residential properties nationwide.

Use our range of calculators such as Cordell Sum Sure to assess rebuild costs, taking into account material and labour costs, council and development fees, plant hire and waste removal.

Understand how property-specific attributes like site access, local building regulations and slope affect rebuild costs.

Get costs based on the property’s location, such as local labour rates, transport costs and material pricing.

Account for the potential impacts of environmental hazards, with disaster modelling such as flood risk ratings.

Our data is updated dynamically from key industry suppliers, with costings verified regularly by our in-house experts.

If we detect that our models need adjusting, we’ll notify you if any price shift exceeds 5%.

Solving the Home Insurance Problem in Aotearoa New Zealand

Insights into the state of home insurance in Aotearoa New Zealand, based on data collected from over 1,000 Kiwi homeowners

Download whitepaper

Optimise pricing of premiums

Optimise your premium flows by ensuring risks are identified and priced.

Optimise pricing of premiums

Optimise your premium flows by ensuring risks are identified and priced.

Evaluate risks and hazards across your portfolio – either by the total market or a specific region.

Target profitable business through better risk identification and pricing.

Measure your pre- and post-fulfilment claim costs against industry and regional averages.

Use Cordell Sum Sure Portfolio Review to get invaluable guidance in relation to portfolio purchases and transfers, or mergers and acquisitions.

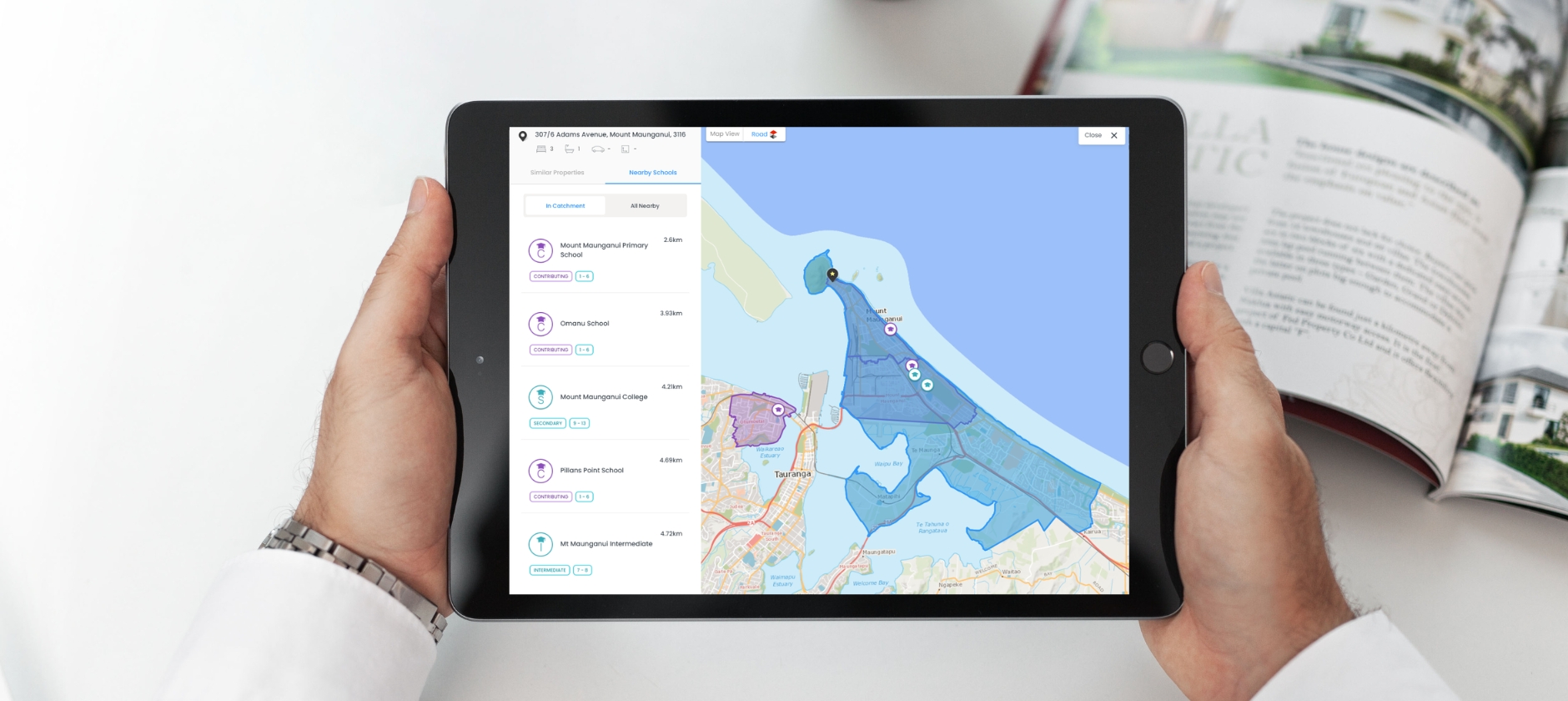

Delight your clients and identify new ones

CoreLogic’s data-driven solutions can help you find acquisition and cross-sell opportunities, while enhancing the insurance journey for your current clients.

Delight your clients and identify new ones

CoreLogic’s data-driven solutions can help you find acquisition and cross-sell opportunities, while enhancing the insurance journey for your current clients.

Identify when clients are buying, selling or renovating their home and may need to update their cover.

Easily estimate the sum insured your customers need, while potentially saving them costly valuation fees.

Renovation Calculator can help you engage with clients who may need to update their cover when renovating.

Fuse Cordell Sum Sure with CoreLogic data to build digital quotes quickly and easily, with fewer questions needed.

Explore a sample of our leading geospatial data

The NZ MasterMap portal makes it easy to explore insights, assess the quality and see how CoreLogic location data can support smart decision-making.

Visit portal

Manage your risk exposure effectively

Minimise the risk of underinsurance and mispriced policies, protecting your business and your clients.

Manage your risk exposure effectively

Minimise the risk of underinsurance and mispriced policies, protecting your business and your clients.

Integrate detailed rebuild cost data into your quote and renewal flows.

Better understand property profiles to limit your exposure to unidentified or mispriced risks.

Assess your exposure and cover capacity limits to inform your underwriting strategies for high-risk properties and regions with CoreLogic's Climate Risk Solutions.

Measure the portfolio-level impacts of natural hazards to support price and structure negotiations.

Ensure your contracted building trades are working within costing guidelines.

Support clients in the worst-case scenarios and help them to rebuild with the best possible support when they need you the most.

A smoother end-to-end insurance journey

Engage your clients with the right tools and information at every stage in the home ownership lifecycle.

A smoother end-to-end insurance journey

Engage your clients with the right tools and information at every stage in the home ownership lifecycle.

Our Claims Connect software provides secure, real-time access to claims data so you can process claims faster via a shared information portal.

Use CoreLogic APIs to seamlessly integrate our data with your own systems so you can better understand your clients’ insurance needs.

With Cordell Sum Sure Portfolio Review, you’ll know when to connect with clients who may need to reassess their cover before renewal time.

Driving a smarter approach to home cover

Honey Insurance is using property data to transform the home insurance experience

Find out how

Latest news and research

More News & Research

Tariff uncertainty keeps OCR ‘downward bias’ in place

Chief Property Economist Kelvin Davidson unpacks the February cash rate decision and Monetary Policy Statement, and what it means for the housing market.

How can we help you?

Let's get this conversation started! Our team is here to provide you with more information and answer any questions you may have.