It’s still pretty quiet in terms of the number of property sales taking place. Indeed, there were approximately 5,250 deals (via agents and private) in August compared to the long term average for August (over two decades) of around 7,800.

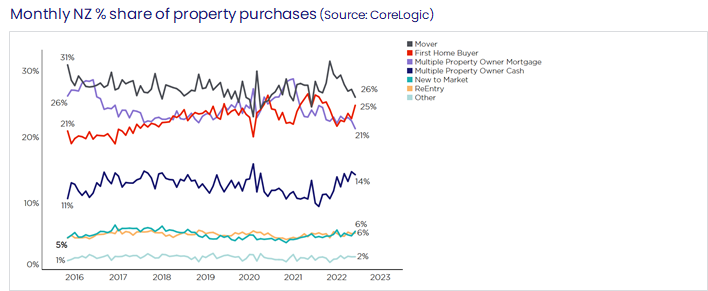

These reduced levels of activity need to be kept in mind when looking at market share figures. But even so, the CoreLogic Buyer Classification data for August showed some interesting angles, perhaps hinting that some buyer groups especially first home buyers have passed ‘peak pessimism’.

First home buyers (FHBs) accounted for 25% of property purchases in August, their highest market share since December last year, and up steadily over the past four to five months from the trough of 21% in March (see the first chart). On one hand, the continued dampening effect of the loan-to-value ratio rules on FHBs will have prevented some would-be buyers from making a purchase, while others have no doubt held back willingly, with the aim of getting a cheaper price (and/or better house) later down the track.

However, others have clearly remained keen to buy, perhaps recognising ‘picking the bottom’ of the market is difficult, and in the meantime they might also miss out on a house they really like. The easing of the CCCFA rules in recent months (with more to come in 2023) may have helped too, alongside the raising of the price caps for First Home Grants and the removal of caps for First Home Loans. The recent increase in the cap for KiwiBuild homes might also allow developers to bring forward more of these properties, improving options for would-be FHBs in the coming months too.

Meanwhile, the market share for cash multiple property owners (MPOs) has also risen, up from around 9-10% late last year to 14-15% recently. To be fair, some of these buyers may have just rejigged the debt on other properties in a portfolio, meaning that the latest purchase isn’t ‘cash’ per se. But even so, in this environment where mortgages are costlier and harder to get, it stands to reason that cash buyers – potentially seeing ‘bargains’ – would have a higher share of the market.

On the flipside, mortgaged MPOs have seen their market share fall, dropping to 21% in August – a record low. New-builds remain popular with mortgaged investors (given continued interest deductibility and shorter Brightline), but this type of property is a relatively small share of the stock. Generally speaking, this buyer group is facing pressure from the pincer movement of low rental yields (and slowing rental growth) and higher mortgage rates, as well as the stringent 40% deposit requirements. It’s probably also worth noting the returns on potential alternative assets, such as term deposits, have risen too.

And finally, relocating owner-occupiers – i.e. movers – have also pulled back a little lately in terms of market share. As explored a few weeks ago, it still requires quite a bit of extra money to trade up from a three to a four-bedroom property, which remains a barrier for some movers. But the change in market circumstances (e.g. less bridging finance) and the return of more conditional offers – e.g. needing to sell before committing to a purchase – will also be slowing things down and perhaps stopping some deals altogether.

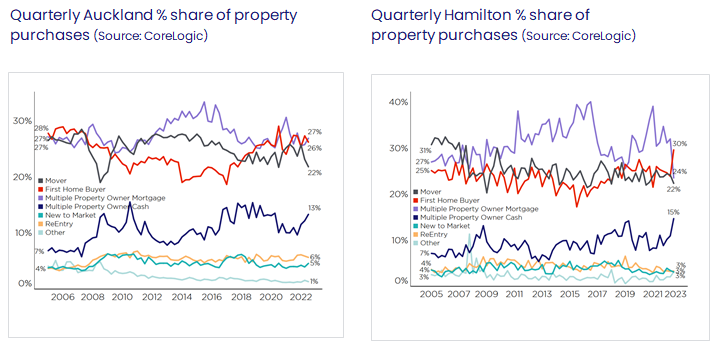

What about around the main centres? There are always exceptions to the rule when you disaggregate the figures, but generally speaking, cash MPOs have had a rising market share, FHBs have also been increasing (in % terms), while mortgaged MPOs have had a reduced presence.

Indeed, Auckland has recently seen FHBs hold on fairly well, although mortgaged MPOs have held up better than elsewhere too (see the second chart, which shows the data on a quarterly basis). Hamilton has shaped up in a similar fashion, with cash MPOs and FHBs seeing a higher market share, but mortgaged MPOs making relatively fewer purchases (see the third chart).

Overall, it’s clear that the property market still faces some challenges and mortgaged MPOs, in particular, seem to be finding it tricky to get the sums to stack up at present. However, FHBs seem to have been taking a few more opportunities in recent months – potentially signaling a change in mood/mindset about the outlook, and adding to the prospects the wider downturn may end in 2023.