Gross mortgage lending flows remained soft in August, with low-deposit finance hard to secure – just 0.7% of investors got such a loan last month (excluding new-builds), and 4.1% for owner-occupiers. A cautious attitude towards low equity loans isn’t hard to understand in an environment where property values are still falling. More generally, after a period where mortgage rates showed signs of a peak, the renewed increases in the past week or so will remain testing for new borrowers, and those rolling off older fixed loans.

Given that property sales data for August has already been available for a few weeks now – and it remained very weak – there were no surprises to see that gross mortgage lending activity (across new loans, top-ups, and bank switches) was also sluggish last month. The total lending flow of $5.4bn was significantly lower than the same month last year ($8.2bn), and in fact was the lowest figure for the month of August since 2019. Moreover, when measured by the number of loans (15,109), activity was the weakest since at least 2013.

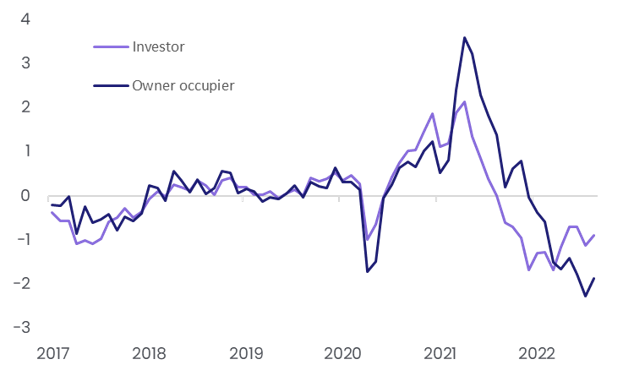

Looking at the breakdown by borrower type, it’s clear that both investors and owner-occupiers are struggling, with lending continuing to fall in recent months (see the first chart). Our own CoreLogic Buyer Classification data has shown a similar pattern in recent months, albeit with some signs of a pick-up for first home buyers lately.

Annual $ change in lending flows (Source: RBNZ)

There were hints in the data that a pick-up for interest-only (I-O) lending has helped some investors purchase property in the past few months, but generally speaking, I-O lending remains under control. Certainly, given the removal of interest deductibility for purchasers of existing property, there’s now more of an incentive for investors to repay some principal anyway.

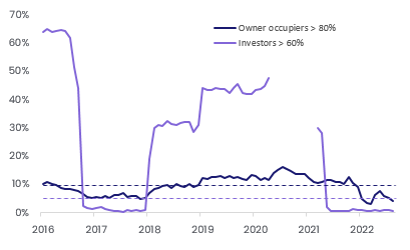

Turning to the breakdown of the figures by loan to value ratio, it’s clear that low deposit mortgages remain very difficult to secure. After exemptions (e.g. for new-builds), just 0.7% of investor loans were approved with less than a 40% deposit in August – versus the speed limit of 5%. And only 4.1% of owner-occupier loans had <20% deposit, against the speed limit of 10% (see the second chart). Given continued falls in property values, it’s not hard to understand a cautious attitude from the banks when it comes to approving loans to borrowers who already have lower equity levels. With housing affordability still stretched and mortgage rates higher, it’s likely that fewer borrowers really want a high LVR loan either.

Share of lending at high LVR (Source: RBNZ)

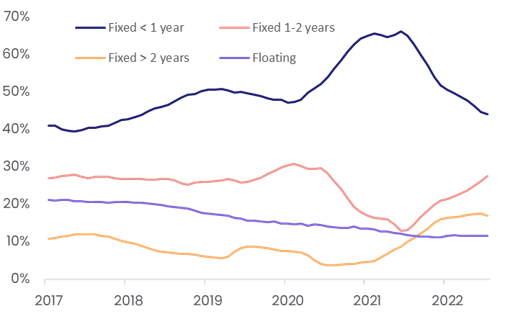

Looking ahead, a key issue for the mortgage market in the coming months is the pressure that will apply to many borrowers as they roll off previous low interest rates onto a much higher repayment schedule. To be fair, the scale of this ‘refinancing wave’ isn’t as big as it used to be – currently 44% of existing mortgages (by value) are fixed and due to roll over in the next year, which is well down from the peak of 66% in June last year, and back down to levels last seen in early 2018 (see the third chart).

Share of existing loans on various terms to maturity (Source: RBNZ)

However, anybody rolling onto new rates will still be seeing a large change in their repayments, given the sharp increases since the middle of last year. And although it’s fairly safe to say we’re closer to the peak for mortgage rates than the trough, it’s still far from certain that mortgage rates have actually topped out yet – even despite strong competition amongst the banks.

That said, it’s encouraging that most borrowers seem to coping pretty well – helped by low unemployment. The Reserve Bank data suggests that lenders haven’t felt the need to increase their provisions for bad debts too much, and just 0.2% of loans are non-performing (where payments are 90 days late or have been classed as ‘impaired’).

On the whole, then, it’s clear that mortgage lending activity remains pretty quiet. There hasn’t been anything to indicate that the RBNZ is considering a near-term loosening of the LVR rules either, and in the meantime, they’re actually still working on more lending restrictions in the form of potential caps on debt to income ratios – albeit not until mid-2023 at the earliest, if required. Interestingly, high DTI lending is already tightening up anyway, due to some combination of banks’ own policies, reduced borrower demand, and also the simple effect of higher mortgage rates – which naturally reduce the amount of debt a borrower can service for any given income.