Falls in national property values continued to moderate in July, and with the latest data showing increases in some parts of the country, it all but confirms that the downturn is in its final stages.

CoreLogic’s House Price Index (HPI) dropped by 0.4% in July, with the three-month change at -2.3%, taking the annual decline to 10.1%. The 0.4% national fall in July was the smallest decline since the 0.3% fall in January, and a significant deceleration from June’s 1.2% fall.

CoreLogic NZ Chief Property Economist, Kelvin Davidson said there were signs in key regions of prices stabilising or in some cases even growing. Indeed, values in five of the seven main sub-markets in Auckland were either flat or higher in July, with most of the other main centres down a marginal 0.2% or 0.3% in the month.

Meanwhile, Mr Davidson said values for the wider Wellington market increased by 0.3%, registering the city’s first rise since February 2022.

“July’s drop in prices at the national level may seem surprising, given the recent commentary about an emerging turnaround for the housing market. But it’s important to note that the latest decline is the smallest in six months, and also that some regional markets saw values rise, most notably Wellington,” he said.

“Market indicators started looking stronger in June and that positive momentum has continued in July. There are several key factors pointing to the trough for house prices, including a broad peak for mortgage rates, albeit some further tweaks by the banks can’t be ruled out, an easing in the CCCFA and LVR rules, still-high employment, and solid net migration flows. The easing in LVR policy has already helped more low deposit investors into the market, such as those with 35-40% deposits who were previously locked out.

“We’ve also seen a pick-up in the volume of sales, stock on the market is dropping, and this is likely starting to result in the re-emergence of competitive price pressures.”

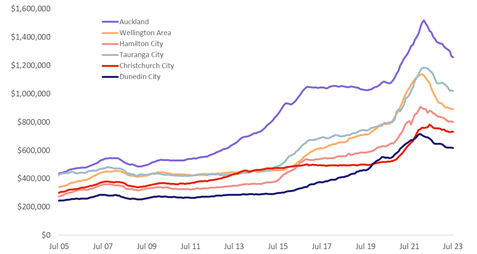

CoreLogic House Price Index – Main Centre Average Value

Mr Davidson said the shifting national fundamentals appeared to be mirrored across most of the main centres, with Hamilton, Tauranga, Christchurch and Dunedin each recording a fairly modest drop in average property values in July, of either 0.3% or 0.2%. Auckland’s drop was more significant at 0.6%, but that weakness was not universal for the super-city as a whole, instead occurring in only one or two of its sub-markets

The July result was notable in Wellington for being the first increase in average property values (0.3%) in 17 months. Amongst the sub-markets, Kapiti Coast was flat in July, as was Lower Hutt. But Upper Hutt rose by 0.2%, Wellington City by 0.4%, and Porirua by 0.6%.

“It’s early days for the Wellington market, but the fact that values previously dropped so significantly suggested that it could be among the first areas to bounce back and lead any recovery too. That dynamic might have just started to play out in July’s result,” Mr Davidson said.

Auckland has been another key part of the country to have seen significant falls in property values during this downturn. But July’s data also showed hints of a turnaround despite Auckland City recording a decline of 1.6% in July and Rodney values dropping 1.4%.

Waitakere was more or less flat with a minor 0.1% drop, Franklin stabilised, while North Shore, Manukau, and Papakura rose more significantly.

“There are still appreciable affordability challenges for buyers across Auckland, whether that be first home buyers, investors, or relocating owner-occupiers. But July’s data nevertheless did start to hint that demand has returned in many areas,” Mr Davidson acknowledged.

Regional House Price Index results

Outside the main centres, property value trends remained a bit patchy in July, as was typically the case at a wider turning point for the market, Mr Davidson said.

Queenstown, Rotorua, Napier, Whangarei, Gisborne, and Whanganui all recorded sizeable drops in value in July, although Queenstown remains higher than the levels recorded at the same time in 2022. By contrast, Invercargill values were stable, with Palmerston North and New Plymouth recording increases. Those three areas have also seen values hold steady or increase over the broader three-month period since April too.

“New Zealand is not just a single housing market and the disparity in the regional results should reaffirm expectations that in many parts of the country the end of the downturn is going to be anything but smooth,” Mr Davidson said.

Property Market Outlook

Mr Davidson said a range of metrics and indicators made it increasingly clear that the trough for New Zealand’s house prices has essentially arrived, with further evidence across all index measures likely to emerge in the next couple of months.

“There will be mixed views about this point we’re at in the cycle. Existing property owners will no doubt be pleased but there are always two sides to the coin in the housing market, and aspiring buyers would clearly prefer to see further declines,” he said.

“Reaching a trough in the downturn does not mean there’s likely to be a sudden snapback to widespread and strong gains in house prices and it will be unsurprising if some areas record further falls in the coming months, while others stabilise or see mild increases. Generally speaking, the ‘next phase’ of the cycle could still be relatively muted, given that affordability remains stretched, mortgage rates aren’t set to drop anytime soon, and also in light of the prospect of caps on debt-to-income ratios for mortgages early in 2024.”

Download the latest House Price Index