It’s still a big financial hurdle to move to a larger property in most parts of NZ. The gap in median values between three and four-bedroom dwellings is more than $200,000 in Auckland, Hamilton, Tauranga, Wellington City, and Christchurch. However, this ‘trade-up premium’ has dropped almost everywhere in the past year. As some confidence slowly returns to the market, pent-up demand from households keen to relocate may start to show through in the second half of 2023.

Each year we take a look at the ‘trade-up premium’, or the amount of extra equity and/or debt that a household would need to find to ‘move up the ladder’. We proxy this by using the gap in median values between three-bedroom and four-bedroom properties across the country. (Note - this can also be flipped to show the amount of equity/debt someone could free up by downsizing.)

The 2023 refresh of the data reveals some pretty interesting patterns. Most notably, the continued downturn in property values over the past year has seen the trade-up premium shrink in most parts of NZ, or in other words, things have shifted a bit more in favour of those looking to get that extra space. The largest % drops in the premium have been in Upper Hutt (24%), Lower Hutt (16%), Wellington City and Tauranga (both 15%).

Now, just to be clear about the maths. The median values for each property type in each area have dropped by pretty similar amounts in % terms. However, given the four-bedroom properties start at a higher level in $ terms, any given % drop also translates into a bigger fall in $ terms – which shrinks the premium.

It’s also important to note that even after the recent value falls, the trade-up premiums are still quite large. They range from around $150,000 in Upper Hutt and Dunedin, to between $200,000-$250,000 in areas such as Franklin, Tauranga, Wellington City, Waitakere, Hamilton, Christchurch, and Papakura.

Meanwhile, the premium still exceeds $300,000 in Auckland’s North Shore and Manukau areas, and is about $530,000 in the City (the old central council area). Outside those Auckland sub-markets, the only other parts of the country with trade-up premiums in excess of $300,000 are Queenstown ($345,000), Waipa ($314,000), and Hastings ($306,000).

At the other end of the spectrum, trading up will ‘only’ cost $35,000 in Kawerau, $64,000 in Otorohanga, and $74,000 in Clutha, with seven other parts of NZ below $100,000 to trade-up.

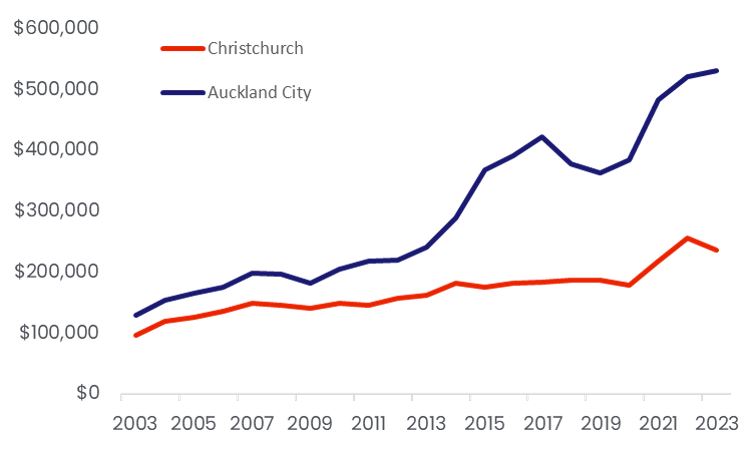

But just to return now to Auckland City, not only does it have the highest trade-up premium for any part of NZ, but it has actually also increased a bit over the past year. With an annual drop in median value of 11% for three-bedders in this market, versus a lesser fall of 8% for larger-sized homes, the trade-up premium has increased by $11,000 since the middle of 2022 – and by $148,000 since the middle of 2020 (from $383,000).

It’s quite a stark contrast between Auckland City and, say, Christchurch, where those looking to trade up are probably having an easier time doing so (see second chart). Of course, the concentration of ‘super-prime’ suburbs in the Auckland City area, such as Herne Bay, makes it relatively easy to explain why it costs a lot to take each step up the ladder.

2. Trade-up premium

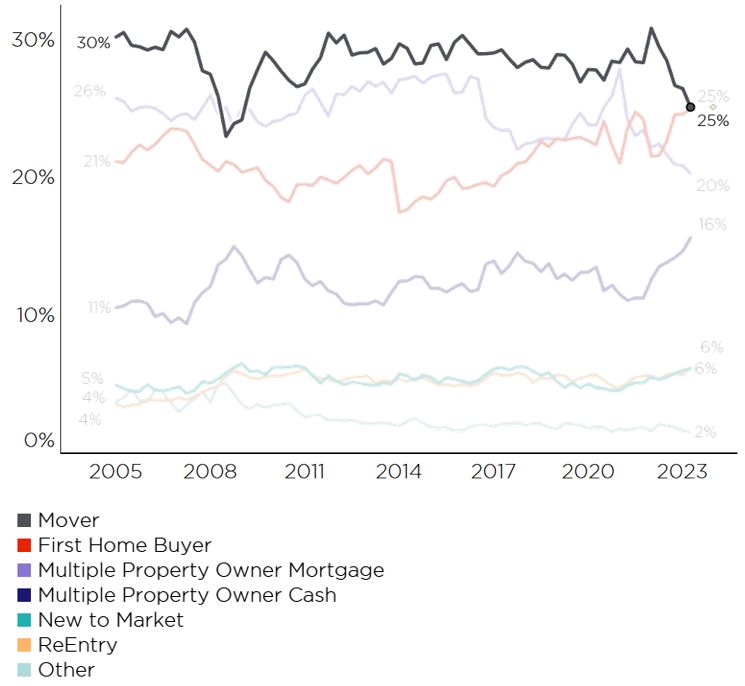

So what does this all mean? It’s certainly still a challenge to move up from a three-bedroom to a four-bedroom property in $ terms, and there’s no doubt that ‘movers’ (relocating owner-occupiers) have been fairly quiet lately (see third chart). Part of this reluctance to move has probably been uncertainty about the length of time a sale would take, what price would be achieved, and the hurdle of trying to sell before they buy.

3. Market share % of property purchases

Another downside is putting all of that extra cost to trade up onto a bigger mortgage, with the higher cost of debt.

That said, a downturn (and subsequent period of broad stability that we now expect for property values) can also be a good time to trade. After all, if your property has lost value, there’s every chance that the next one will have dropped too, and that can lead to ‘profitable’ relocations - either in terms of saving a bit of money or getting a better house for the same price.

Certainly, one buyer group we’ll be keeping an eye on in the next six to nine months is investors, as they potentially look to benefit from reinstated interest deductibility (IF National win the election) and possibly also try to buy before debt-to-income limits kick off.

But movers are definitely another group to watch. With trade-up premiums having fallen, and a degree of confidence now slowly returning to the property market (as job security stays high and mortgage rates peak, for example), it wouldn’t be a surprise to see some pent-up demand from households keen to relocate starting to emerge in the rest of 2023.