In today’s Pulse, CoreLogic's Chief Property Economist Kelvin Davidson explores a number of ongoing and emerging trends in New Zealand’s property market, including the continued strength of first home buyers (FHBs) compared to relatively low levels of activity from relocating owner-occupiers (‘movers’) and mortgaged multiple property owners (MPOs) – along with early indications that new investors are beginning to re-enter the housing market.

Investors eye new opportunities?

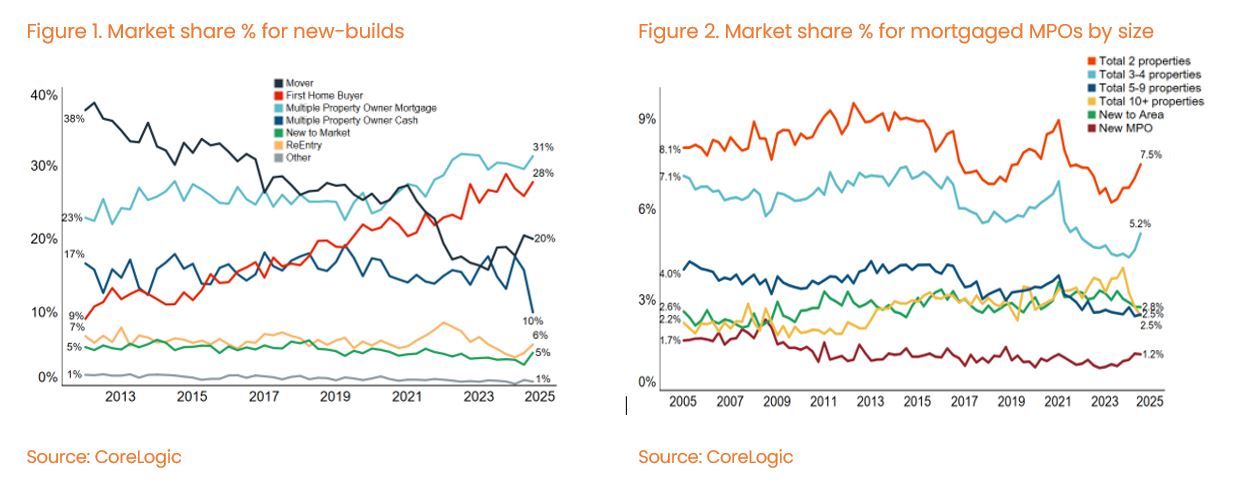

First, we’ll take a look at buying activity for new-builds* versus existing properties. This distinction has become a little less relevant for some buyer groups (especially investors) in the past few months, as the mortgage interest deductibility and Brightline Test playing field has been levelled out. However, the loan to value ratio (LVR) rules and debt to income (DTI) restrictions still favour new-builds, so there’s still considerable interest here.

As the first chart shows, the share of new-build purchases going to mortgaged MPOs rose sharply from around 25% in 2020 (and prior) to more than 30% in 2022 – as the tax rules shifted in favour of new-builds – and has stayed at that higher level in 2023 and so far in 2024. Meanwhile, first home buyers have also become a bigger player in the new-build segment over time, with the LVR rules likely to have played a role (new-builds require smaller deposits) and also the fact that more new-builds in recent years have been townhouses, which are cheaper than other types of dwellings. That lower entry price for townhouses will have tended to help FHBs overcome any affordability hurdles.

We can also split the data by portfolio size, and it’s interesting to see a few tentative hints in recent months that mortgaged MPO 2’s – i.e. people who own two properties after their latest purchase; essentially a new investor – might just have started to eye up the housing market again (see the second chart). The MPO 3-4s are also showing glimpses of a rise, but the market share for larger players (MPO 10+) has tailed off in the past 6-9 months. In other words, new investors might be slowly returning, as term deposit and mortgage rates dip, and the tax rules become more favourable; however larger existing landlords are biding their time, to some extent comfortable with their current holdings.

(*Any properties we identify with the first title transfer being within 12 months of the year built. The sale price could of course have been agreed much earlier.)

Movers poised for a comeback?

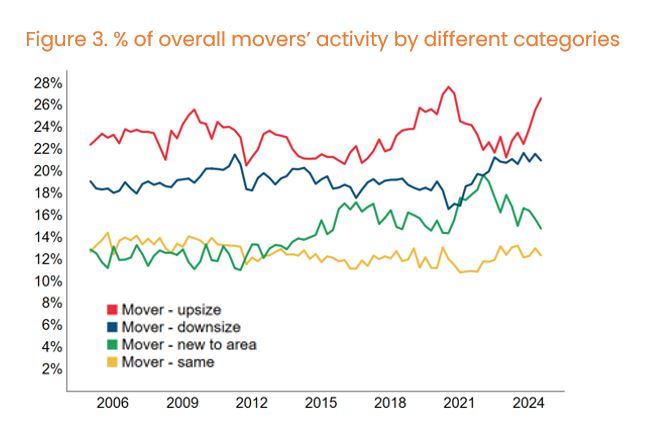

Another cut of the figures is to focus only on movers and assess the choices they are making. Broadly speaking, this group has been relatively quiet in recent years, with factors such as market uncertainty and challenging financing conditions meaning more of them have been happier to just stay put rather than shift house. But of the mover activity that has happened, the third chart shows some interesting patterns, with ‘new to area’ (shifting locations) not as prominent as it was in 2021 and 2022, but downsizing still an important trend, while at the same time upsizing has become relatively more popular this year too. This fits with the general ‘rule of thumb’ that a weak market can be a good time to move up the ladder because although you might take a price hit on your own property, there’s the possibility of a bargain on the next one too.

FHBs remain resilient

The split of the types of property that different groups are buying and what they’re paying is also pretty interesting. For example, in 2024 73% of FHB purchases have been standalone houses, paying a median for those properties of $695,000. Houses represent 74% of movers’ purchases in 2024 to date, with a median paid of $875,000 – no real surprise there, that relocating owner-occupiers tend to operate in a higher price bracket than FHBs.

And finally, houses are ‘only’ 64% of mortgaged MPOs’ purchases in 2024 to date, with a median for those houses of $806,500. The lower share of houses amongst investors’ purchases illustrates their greater tendency to look at smaller dwellings such as townhouses, where there are more new-builds.

The outlook for 2024 and beyond

Looking ahead, it wouldn’t be a surprise to see FHBs maintain a solid presence in the market for at least the rest of 2024. After all, they always tend to ‘find a way’, and have quite a few things in their favour at present, such as access to KiwiSaver for at least part of the deposit and a strong hold on the low deposit lending allowances at the banks.

But as the current gap between mortgage rates and rental yields closes (thereby reducing the cash top-up for a typical property), there are also reasons to think ‘Mum and Dad’ investors could become a little more prominent again next year, perhaps drifting back towards existing stock rather than new-builds to some extent – although the DTI rules will keep a lot of investors firmly in the new-build camp too.

And for movers, ‘life still happens’, so their relative lack of activity in recent years suggests there’s probably a degree of pent-up demand to shift. Provided that more owner-occupiers can start to sell their current house a little more quickly, activity in terms of movers shifting onto that next property could also be a little stronger over the next 12-18 months.