The ‘perfect’ strategy for fixing mortgage rates through time is only ever known in hindsight, however new data points to a strong preference for short-term loans. At a macro level this means any reduction in rates will flow through to balance sheets quickly, but with the labour market weakening there are clear ‘tail risks’ to watch for in terms of rising loan repayment problems.

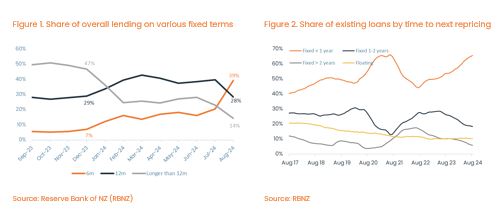

As it’s become clear in recent months that the medium-term outlook is for fairly steady declines in the official cash rate and mortgage interest rates, there’s been a strong preference for borrowers to take out short-term fixed loans. In December last year, for example, 36% of new loans (by value) were taken out for a fixed term of up to 12 months. But that had spiked to 56% by February and reached a new record high of 68% in August – driven by an especially large surge in six-month activity, off the back of that first OCR cut. That spike is shown in Figure 1.

Our analysis suggests that existing borrowers who are rolling over their loans onto a new fixed rate will have been behaving in a very similar way to new borrowers, and indeed the Reserve Bank’s figures show that the share of existing loans that are currently fixed but due to change mortgage rates (‘reprice’) within the next 12 months has now risen back to around 66% – matching a peak previously seen in the first half of 2021, as shown in figure 2. Some of that stock growth will have also come from all of those recent new borrowers who have been fixing short too.

In hindsight, it might not have been the best decision for borrowers – in aggregate - to fix for such short periods back in mid-2021 (unless they wanted loan flexibility for lump sum repayments, as an example). Indeed, anybody who bucked the trend and took out a five-year rate of around 3% at that time will still have about 18 months to run at those ultra-low rates. On the other hand, one can understand why borrowers are now choosing to take shorter fixed periods in the hope they will benefit from a series of loan renewals in the coming year or two at ever-lower rates.

On that note, the one-year change in the average ‘special’ (high equity) one-year fixed mortgage rate, for example, has recently turned negative for the first time since mid-2021; i.e. people currently rolling off a one-year rate from October 2023 will be seeing their costs fall. Some of the currently available market interest rates have recently dropped below the average rate prevailing across the stock of existing fixed loans for the first time in about three years too. This is shown in Figure 3.

Of course, much like it wasn’t necessarily an easy decision to decide on the ‘best’ fixed rate back in mid-2021 (although it’s clearer in hindsight what should have happened), it’s not necessarily straight-forward now either. After all, the very short-term rates (e.g. six months fixed at 6.7%) remain quite a bit higher than the slightly longer terms (e.g. 12 months fixed at 6.2%) – so for the strategy of taking two consecutive six-month fixes to pay off (i.e. to get the lowest average rate over the relevant term), that rate basically needs to drop to 5.7% or less by April next year.

Could that happen? Nothing’s out of the question, especially given the continued weakness of the economy and an emerging risk that inflation falls much more sharply than has been anticipated; which would likely see the OCR also fall more rapidly, alongside extra downward pressure on mortgage rates. But at the same time, there could also be a sense at the moment that some of the potential future falls in the OCR have already been captured (‘priced in’) by current mortgage rates, meaning that the scope for more declines from here, regardless of the fixed term, could be a bit slower/smaller than what we’ve seen to date. Either way, the delicate decisions currently faced by mortgage borrowers may continue for a while yet.

In addition, even though interest rates are now falling, it doesn’t necessarily mean we’ve passed the worst for financial stress amongst mortgage borrowers. Indeed, the non-performing loans ratio (loans that are at least 90 days in arrears or regarded as impaired) on banks’ books has recently edged up to around 0.6% of existing mortgages, the highest figure in more than a decade. It was close to double that figure in 2009-10, however, these numbers are surely still a concern – and could continue to rise, given the job losses that we’re now seeing.

Based on RBNZ figures, the trading banks themselves recently seem to have been raising provisions for possible future ‘bad’ housing loans, to the point where these allowances are now about 40% above even the largest COVID-era figure. Mortgage stress will remain a factor to watch for some time to come yet and is another reason to be cautious about the size and strength of any upturn in house sales and prices as we head into 2025.