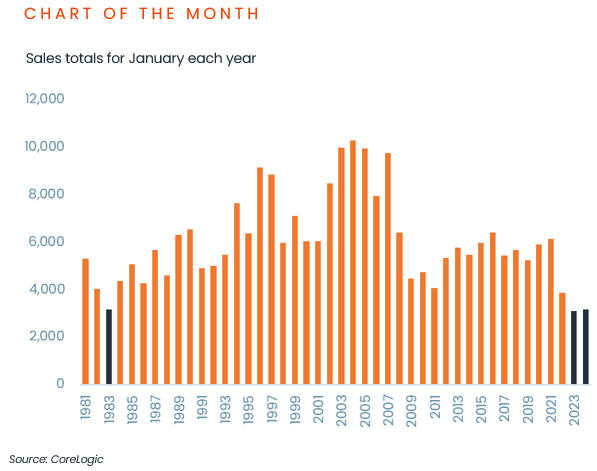

High mortgage rates continue to pressure the housing market, contributing to patchy volumes month to month, and January sales activity reaching its second lowest level in about 40 years, according to CoreLogic's February Housing Chart Pack.

Figures measured across agent-led and private transactions show there was a total of 3,169 sales in January. This is up only 2% on the same month last year where levels were at 3,108, which marked the slowest start to the year since 1983.

CoreLogic NZ Chief Property Economist Kelvin Davidson said the weakness in sales just highlights the variability from month to month.

"January's sluggishness in sales is a timely reminder that the housing market is still facing quite a bit of mortgage rate pressure," he said.

Despite this, Mr Davidson said there is still clearly a gradual upturn underway, as sales volumes have risen compared to a year earlier in each of the past nine months.

On a 12-month basis, national sales have increased 4.5% to more than 67,000. This is up from the April trough of less than 62,000 annually, but still well below 'normal' levels of 90-95,000 per year.

The upwards trend is also reflected in total sales across the main centres (5.0%) and provincial markets (3.6%) over the 12 months to January.

"Arguably, listing levels have returned to some kind of normality now, so the reduced sales over the past month probably hints at some uncertainty around buyer demand, rather than a lack of choice."

Mr Davidson also suggested, however, that February could see some kind of bounce-back, given that January was perhaps weaker than expected.

"It’ll be interesting to see how sales and listing activity evolves in the next month or so, and how market confidence moves too. We suspect the demand would be there to match any additional supply coming on to the market, resulting in an associated rise in agreed sales activity as buyers can see more choice," he said.

February Housing Chart Pack highlights:

- Residential real estate is worth $1.62 trillion.

- National property value gains eased in January, with a rise of ‘only’ 0.4%. Main centres Dunedin and Tauranga slightly outperformed with other markets recording flatter results for the past month.

- Sales volumes in January, across both private deals and real estate agents, were about 2% higher than the same month last year, the ninth rise in a row. And on a 12-month total basis, sales have now risen to 67,400, up from the April trough of less than 62,000, but still well below the average of 90-95,000 per year.

- New listings activity has started to rise back again after the holiday period, with 8,916 new listings over the four weeks ending 11 February, well below the 8,577 from the same time last year and the five year average (11,428).

- Total stock on the market is 36,802, 8% below this time last year.

- Rental growth is still running at historically high levels, and was 6.8% in the year to January (Stats NZ new tenancy/flow measure) – that remains well above the long term average growth rate of 3.2%, and reflects further growth in wages, as well as a tightening supply and demand balance.

- Gross rental yields nationally have edged back up to 3.2% (from a trough of 2.6% for much of 2022), the highest level since late 2020. However, that’s still relatively low by past standards, and is less than the income returns on some other asset classes (e.g. term deposits).

- Around 56% of NZ’s existing mortgages by value are currently fixed but are due to reprice onto a new (generally higher) mortgage rate over the next 12 months.

- Inflation seems to have passed its peak and the Reserve Bank will wait to see the effects of the final 5.5% OCR for this tightening cycle. Mortgage rates are close to, or already at, their peak.

Download the Housing Chart Pack