As high mortgage rates continue to dampen buyer demand in New Zealand’s housing market, residential property sales weakened in June, after a 13-month growth streak, according to CoreLogic’s July Housing Chart Pack.

Figures measured across agent-led and private sale transactions show there were just 4,744 deals done in June; that’s 22.1% down from the same time last year, and breaks the consecutive run of growth since April 2023 (-9.6%).

In contrast, the total stock on the market is currently more than 20% above the same time last year.

“It would appear that some pent-up reluctance by sellers to list in the final few months of last year is now coming forward and turning into available stock this year. That’s creating more choice for buyers and feeding into weaker price pressures.

“Even that reduced pool of buyers with the finance, and who can afford 7% mortgage rates, seem to be taking their time and are seemingly being selective on finding the right property,” he said.

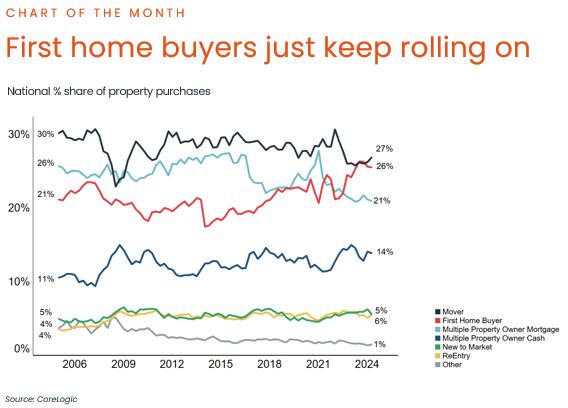

Mr Davidson pointed out that first home buyers (FHBs) showed fewer signs of pulling back, with their activity continuing to hover at record-highs, especially in Auckland (27%) and Christchurch (29%).

“Given the recent loosening in the loan to value ratio rules, it’ll be interesting to see whether that adds an extra boost to FHB activity, who are already making full use of the banks’ low deposit lending allowances,” he said.

“The other big change in recent weeks has of course been the easing inflation environment and stronger indications from the Reserve Bank that official cash rate cuts could be seen before the end of the year. In other words, there’s light emerging at the end of the mortgage rate tunnel for cash-strapped borrowers.”