In today's Market Pulse, CoreLogic Chief Property Economist Kelvin Davidson explores if a new-build premium exists, and its outlook.

We estimate that new-builds are currently running about 6% more expensive than existing properties, which is in line with past norms. Given they’re theoretically of higher quality (e.g. better insulation) than existing dwellings, new-builds will probably always tend to carry a price premium in the future, too. But the gap may get a bit smaller in the next few years, not least as the tax rules become less favourable for new properties relative to existing.

Our recently-developed ‘Market Trends’ dataset contains a breakdown of sales data split by those with a previous transaction (i.e. existing stock) and properties that have just been sold for the first time, i.e. a proxy for new-builds. This may not capture all new-builds, such as some occasions where households have bought a section and commissioned the dwelling project themselves, but it’s still a decent indicator of long-term trends1. And of course, it’s a topic of huge interest given the changing landscape for lending and tax rules, which currently favour new-builds over existing stock.

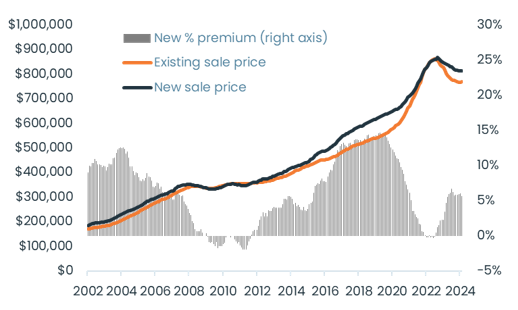

So what do the figures show? As you can see in the first chart, for most of the time since 2002 there has tended to be some kind of new-build premium across NZ, averaging 6% over that period, but ranging quite widely from -2% up to 15%. Interestingly, new-builds were slightly cheaper (i.e. the premium was negative) than existing properties over a period of about two years from mid-2009 to mid-2011, just the time when the construction sector was battling the GFC and its aftermath – suggesting perhaps some discounting was necessary around that time to get new properties sold.

But there have also been periods when the premium has been significantly positive, most notably in double-digits for most of 2002-04, and again from mid-2016 to mid-2020. To some extent, the gap might then have started to close from mid-2020 (with existing prices playing catch-up) due to people rushing in during that post-COVID phase and taking an ‘any house will do’ approach.

Either way, the percentage premium is now currently at average levels of around 6%, but it’s quite significant in dollar terms, ranging from around $40,000 up to about $50,000 over the past year or so. On February’s data itself, existing properties sold for $768,050 versus new-builds of $811,000.

1. New vs. existing median sale prices (Source: CoreLogic)

So what should we make of all of this? The fact that a new-build premium has generally existed through time is no real surprise. After all, they require less maintenance and will tend to be higher quality (e.g. better insulation) than the average existing dwelling, which ‘justifies’ a higher price. On top of that, although the growth has slowed down now, there’s previously been sharp increases in residential construction costs over the past 3-4 years, conceivably meaning that new-builds have simply had to be priced higher to reflect that reality.

In addition, new-builds have been strongly favoured in recent years by the lending and tax rules too, or in other words exempt from the LVRs – meaning maybe a 10% deposit at present rather than 20% for owner-occupiers or 35% for investors – and also still being able to have 100% mortgage interest deductions on landlords’ tax returns. The shorter Brightline Test that has recently prevailed for new-builds (five years) versus existing properties (10) may have also been a factor in the price premium.

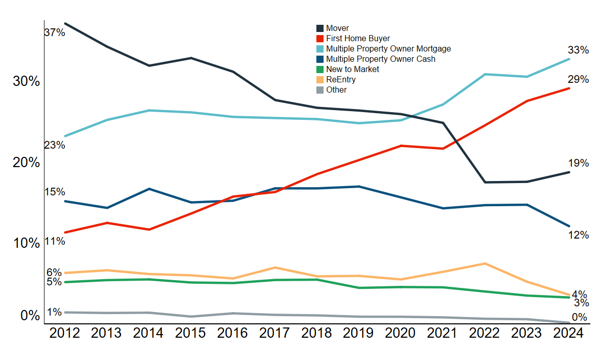

With all that in mind, it’s no surprise that the CoreLogic Buyer Classification data shows that mortgaged investors (and first home buyers) have been taking a rising share of new-build purchases over time – see the second chart.

2. NZ % share of new-build property purchases (Source: CoreLogic)

Looking ahead, however, you’d now tend to think that the new-build premium could start to erode again in the next year or two. For a start, like in 2009-11, with building work slowing and construction costs now much flatter, there’s likely to be less heat in new-build pricing. On that note, there also appear to be some difficulties for developers in securing pre-sales for their new-build projects at present, possibly hinting at some near-term discounting. Meanwhile, more listings coming to the market may also mean that prospective house buyers can already find what they want among the existing stock, and not need to go down the path of buying or building a new property.

In addition, of course, mortgage interest deductibility is set to even out regardless of property age, at 80% from 1st April 2024 and 100% from the same date next year. At the margin, this also erodes the benefits of a new-build relative to existing for investment buyers.

That said, there’s still likely to be a reasonably persistent new-build premium through time, simply reflecting their reduced maintenance costs and higher quality. On top of that, the loan to value and (pending) debt to income ratio rules will still favour new-builds too, meaning people can more easily access them with smaller deposits/larger loans, even though the tax advantages will have gone.

Overall, though, ultimately whether new-builds costs a little or a lot more than existing properties, the bigger point is that we simply need more of them in future, to cater for population growth and to try to keep a lid on housing (un)affordability.

1 We don’t typically favour the use of a median sale price as an analytical tool for the property market, given that over time the end result can be thrown around by the types of property that happen to be selling. But this article primarily looks at relativities of new vs. existing, so the mix-effect is less of an issue.