Chief Property Economist Kelvin Davidson explores the driving forces behind New Zealand’s decade-long house-building boom.

- Townhouses have become a key component of growth for NZ’s housing market, accounting for 45% of all new dwelling consents across NZ lately, compared to just 6% back in 2012.

- Of the 39,600 townhouses built across NZ since 2016, nearly 25,000 have been in Auckland.

- Key Auckland sub-markets including Waitakere and Manukau have seen townhouse stock increase more than 50% since 2016.

It’s been common over the past few years for analysts and commentators to focus on terraced or semi-detached townhouses* from the perspective of sales activity or new dwelling consents. That’s understandable given that townhouses have recently accounted for around 45% of all new dwelling consents across the country, compared to just 6% back in 2012.

However, new data from CoreLogic’s Market Trends dataset shows the growing importance of townhouses/flats and how this has changed over time in various parts of NZ.

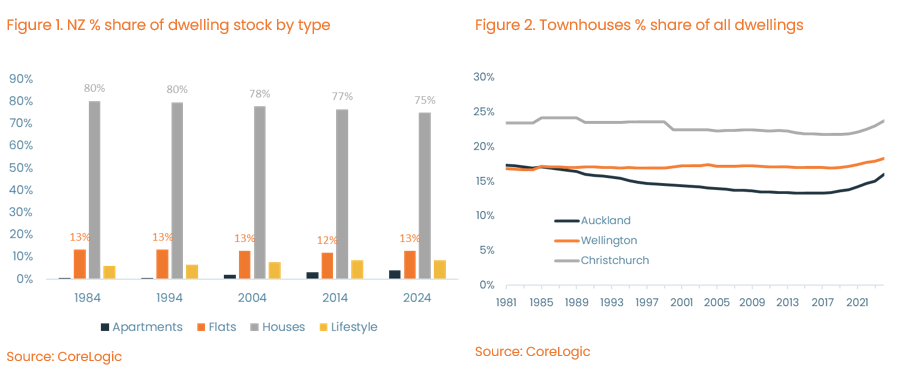

Starting with the national picture, Figure 1. shows the housing stock at 10-year intervals since the early 1980s. Back in 1984, standalone houses accounted for 80% of all dwellings in NZ, but that’s now drifted down to 75%. On the flipside, the reduced share for houses has been mirrored by a rise for apartments and lifestyle properties, and in fact the townhouse and flats category was 13% in 1984 and still sits at that figure today.

The national data also masks interesting trends at regional level. Across our three largest centres (Wellington covers the City, Porirua, Lower Hutt, and Upper Hutt), the townhouse category has been on a clear rising trend for a number of years now, especially in Auckland (Figure 2.) from around 2016 onwards, stemming from the Unitary Plan and the shift to more intensified housing on existing brownfields land.

Christchurch still has a higher share of townhouses (nearly 24%) than Auckland (16%)**, but the latter’s growth in the past 7-8 years has been more significant. Of the 39,600 townhouses built across NZ since 2016, nearly 25,000 have been in Auckland, or approximately 63% of the growth. For comparison, Auckland has about 38% of the national stock of this type of property.

Where townhouse stock has surged the most

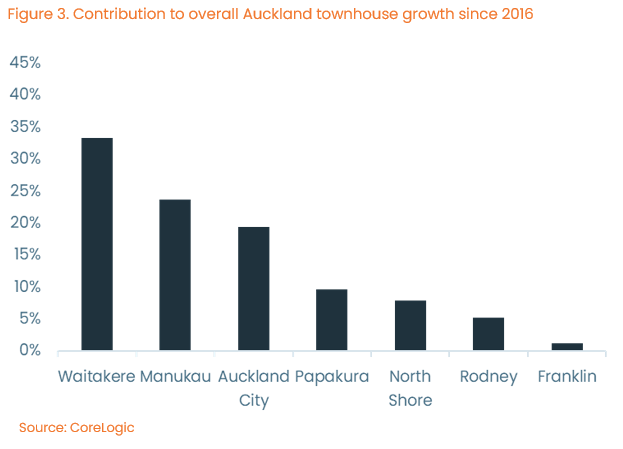

CoreLogic’s Market Trends data shows that the stock of townhouses has risen by roughly 50% or more over the period since 2016 in Rodney, Papakura, Manukau, and Waitakere. But given the smaller size of the townhouse market in Rodney, the biggest contributions to the overall growth across Auckland have in fact been in Waitakere (33%) – which includes areas such as Hobsonville – as well as Manukau (24%), and Auckland City (19%) as seen in Figure 3.

It’s always a little difficult to disentangle supply from demand as the most important driver for the rise of townhouses; did tastes change and developers respond, or have buyers just had to purchase what was available? In reality, it’s likely to be a bit of both, but certainly buyers can access at a lower price point than other dwelling types. For example, our latest median value for Auckland flats and townhouses is around $775,000, versus the figure for houses of about $1.12m.

Overall, it’s clear that townhouses are now a more prominent feature of NZ’s housing market, especially in the largest cities. Given they use land well and can be built close to existing infrastructure such as transport links, they provide a different and cheaper option for a wider range of property buyers. The obvious aim would be that the Government’s current housing supply rule changes – ‘Going for Housing Growth’ – will prove effective in keeping the townhouse building pipeline strong over the medium term, alongside general growth in all dwelling types.

(** At first glance, this might seem a little surprising, but it seems to reflect ‘legacy’ construction in older suburbs nearer the central city, with high numbers of townhouses in St Albans and Sydenham as examples, as well as areas with lots of recent development such as Christchurch Central and Addington.)