In real estate, every lead, appraisal, listing, and negotiation counts, not just for closing deals but for running a profitable business. To stay ahead in a tough market, you need clear insights that inform, help you act decisively and deliver results.

That’s why CoreLogic’s Decoding 2025 survey didn’t just collect data, it captured the responses of 2,400 real estate agents and financial professionals across New Zealand and Australia. This record number of insights offers a unique window into the challenges, opportunities, and strategies that will help shape the year ahead.

Market First Insights from NZ Agents

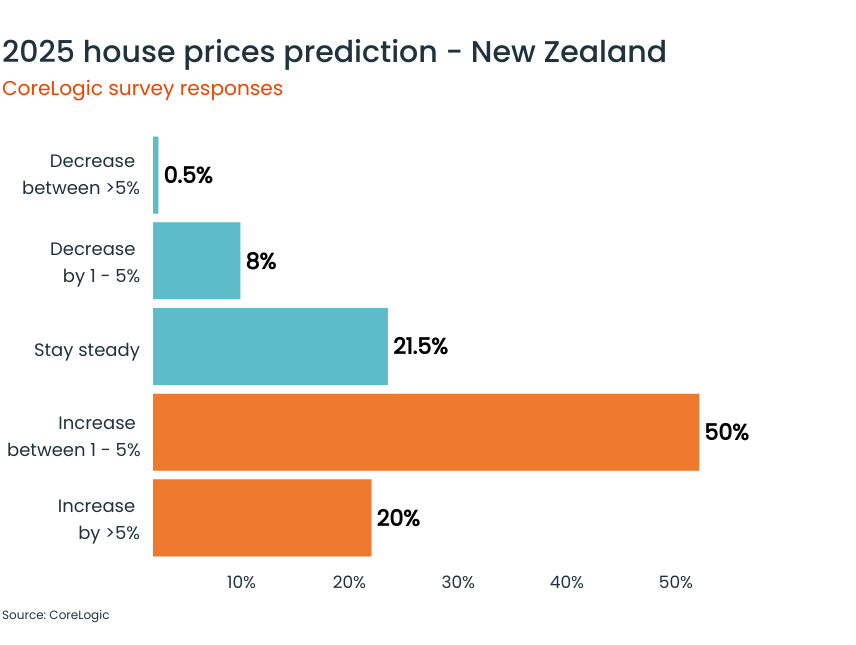

New Zealand agents were included in CoreLogic’s survey, offering a unique look at market sentiment and operational priorities across the Tasman. Despite affordability challenges, the outlook for 2025 is cautiously optimistic, with 70% of respondents expecting house prices to rise.

Kiwi Insights Unpacked

The New Zealand real estate market reflects similar challenges to Australia, with affordability remaining a significant barrier. However, stabilising economic conditions and easing interest rates are expected to play a pivotal role in 2025.

- Property values dipped – The national median value fell to $803,624 in December, down 3.9% year-on-year and 17.6% below the post-COVID peak.

- Only modest price growth expected – One in five agents anticipate price increases of more than 5%.

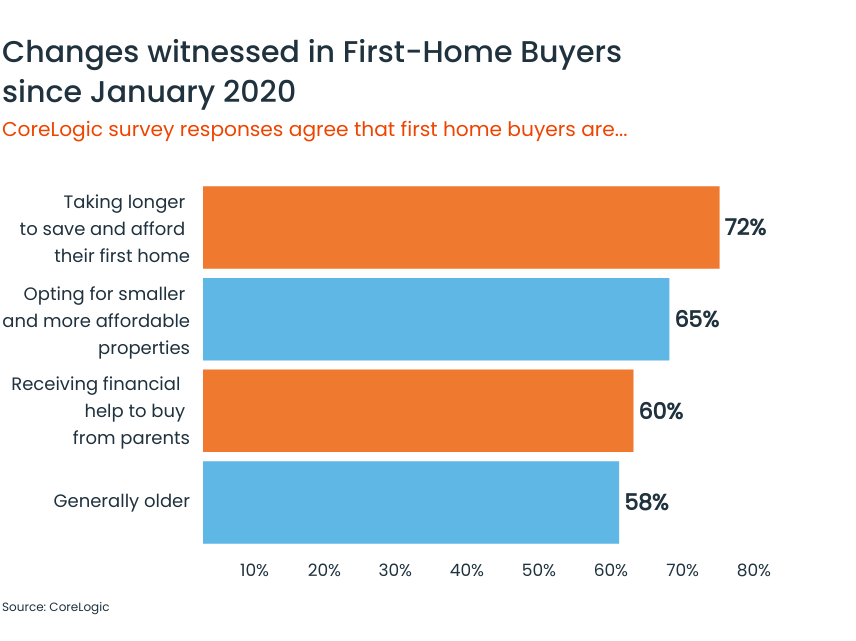

- Affordability challenges persist – High housing costs continue to impact first-home buyers, although easing interest rates may improve accessibility.

“Affordability challenges remain a significant barrier, particularly for first-home buyers, as property prices are still high relative to incomes,” CoreLogic’s Head of Research, Nick Goodall said.

“However, we’re seeing easing interest rates and stable economic conditions improve accessibility in 2025, and this could bring more buyers back into the market.”

Policy Shifts That Could Boost Activity

Government policy changes are expected to influence market sentiment and activity in 2025:

- Reintroduction of interest deductibility – Nearly three-quarters of respondents see this as a catalyst for increased activity.

- Shorter Bright-line tax period – A reduction in the tax period is also anticipated to stimulate the market.

- 75% are already using AI tools, with nearly a quarter relying on them daily to improve efficiency and deliver results.

These shifts could help balance affordability pressures and drive greater confidence among buyers and sellers.

The Rise of AI and Client Engagement

The survey also highlights how New Zealand agents are embracing technology to streamline workflows and connect with clients:

What It Means for 2025

While affordability challenges remain, 2025 presents new opportunities for agents armed with stabilising economic conditions, emerging policy changes, and advanced tools like AI.

“We’re seeing easing interest rates and stable economic conditions improve accessibility in 2025, and this could bring more buyers back into the market,” Goodall said.

With these insights, New Zealand agents are better positioned to navigate the challenges and capitalise on opportunities in the year ahead.

To access the full Decoding 2025 report with results across New Zealand and Australia click the link below:

Decoding 2025 full report