- In today's Pulse, CoreLogic NZ's Chief Property Economist Kelvin Davidson looks at the conditions facing first home buyers (FHBs) in 2025, with the data pointing to favourable market conditions - although their percentage share of activity may not hold at recent record highs.

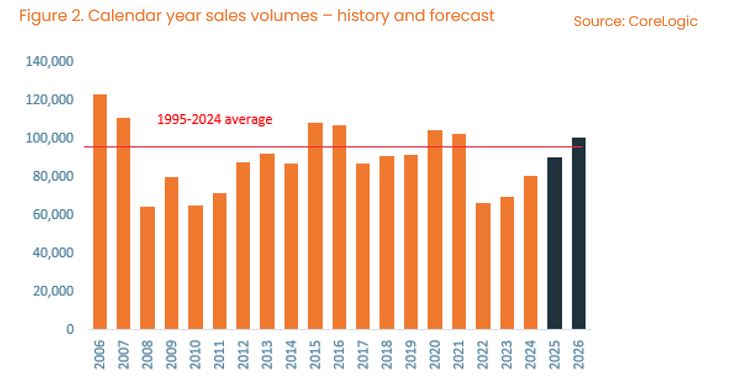

- Even if mortgaged investors and movers do take a greater proportion of activity in 2025, FHBs are still likely to buy a higher number of properties than they did last year.

- Put simply, a larger overall number of transactions in 2025 should ‘float all boats’.

A look back at 2024

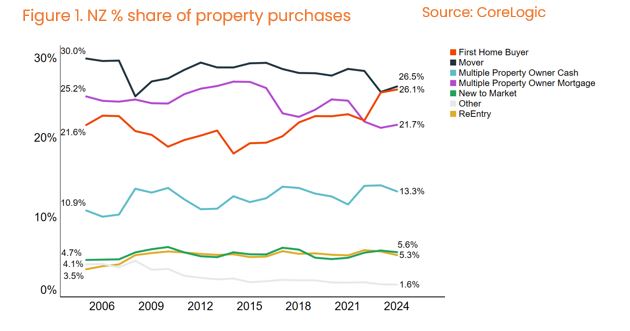

The full-year CoreLogic Buyer Classification data for 2024 showed another strong performance from first home buyers (FHBs), making up 26.1% of property purchases. That was a new record high, surpassing the previous mark of 25.7% set the previous year. Granted, at around 20,850, the number of FHB purchases had been beaten on seven previous occasions since 2005 (including each year from 2019 to 2021), but it was still a solid year on that measure too.

Why have FHBs proven successful? Access to KiwiSaver for at least part of the deposit is one factor, while they have also been making full use of the low-deposit lending allowances at the banks. Getting around the loan to value ratio rules by purchasing new-build properties is another popular option at present, and we estimate that FHBs accounted for about 27% of new-build buying activity in 2024.

FHBs have also been taking advantage of plenty of choice (total available listings are high) and the soft market – their median price paid in 2024 was $698,000 (down from $719,000 in 2022). They are also benefitting from reduced competition. For example, ‘movers’ or relocating owner-occupiers ‘only’ accounted for 26.5% of activity last year, which is about 2%-points below their average.

At the same time, mortgaged multiple property owners (MPOs including investors) have had a tricky few years too, with their share of activity at 21.7% in 2024, versus the average since 2005 of around 24.5%.

That is not too surprising given that typical mortgage rates were above 7% for at least the first half of 2024, meaning that significant top-ups out of other income were required to sustain a standard new rental purchase. Interest deductibility was back to 80% for most of the 2024 calendar year, but the Brightline Test only came down on 1st July 2024 while the deposit rules were eased from 35% to 30% on the same day.

2025 outlook

Looking ahead, our expectation is that overall property sales volumes will rise from around 80,000 in 2024 to 90,000 in 2025, reflecting the lagged effects of lower mortgage rates and the anticipation of a growing economy again, albeit slowly.

That being said, further job losses in the near term are unfortunately looking likely, and debt to income ratio limits will also become a consideration, although the ‘generous’ 20% speed limit and the new-build exemption should mean they don’t put a hard stop on activity.

In this environment, it would not be a surprise to see a higher number of deals from all buyer groups, especially the three main cohorts of FHBs, mortgaged investors, and movers.

Anecdotally, we have seen evidence that movers are starting to become more active again as housing chains free up, especially in the ‘next home’ segment (i.e. previous FHBs who are now looking to trade up), while mortgaged investors have also shown clear signs of a comeback.

Although mortgaged investors’ calendar-year market share in 2024 was still quite low, the quarter-by-quarter figures had turned up by the end of year, hitting 22.6% in Q4 – their strongest result since the middle of 2022. Our more granular analysis shows that this was driven primarily by smaller/new investors (those who now own two properties in total after their latest purchase), or the cliched ‘Mums and Dads’.

To illustrate the impact of lower mortgage rates on those top-ups: If you plug in a purchase price of $780,000 (the median paid by mortgaged MPOs in 2024), assume 30% deposit, 4% gross rental yield, interest-only mortgage (and 100% deductibility), a drop in mortgage rates from around 7% to about 5.5% broadly cuts the weekly cash requirement from $350 to $200. That’s still significant for a new investor, but much less of a hurdle than before.

A story of many buyers

Looking ahead, 2025 looks set to be busier year for the property market in general and across the various buyer groups. However, market share must always equal 100%, and even though FHBs will likely buy more properties this year than last, it is still conceivable that their percentage share of activity will drop back from recent record highs, as mortgaged investors and movers return closer to their normal positions.

In turn, that may well prompt fears or headlines that first home buyers are being shut out again. But as an example, they could see their market share drop to 24% this year and still purchase about 1,000 more properties than in 2024. In other words, a lower market share doesn’t mean the demise of FHBs.