The CoreLogic Hedonic Home Value Index improves how changes in the value of residential real estate in New Zealand are measured and understood.

Drawing on one of the most comprehensive property databases in New Zealand and computed using advanced global index construction techniques, our hedonic modelling distinguishes itself through the depth of our historical data, offering an unparalleled understanding of property in the industry.

Typically, indices are reliable for measuring the property market where centralised valuations are available. Hedonic indices, which require detailed property data, offer an advanced approach but are complex and costly to manage. CoreLogic's strength lies in its extensive data, enabling effective implementation of these advanced hedonic indices.

The Hedonic Home Value Index is:

- Available as a weekly or monthly series.

- Based on historical data back to 2018.

- A timely measure based on unconditional agreed sales (not settlements).

- Produced across properties in New Zealand, including houses, flats/townhouses, apartments and lifestyle properties.

- Geographically rich; covering national, major cities and territorial authorities to the more granular postcode and suburb level geographies.

This comprehensive view offers valuable insights into market dynamics across various sectors, empowering informed decision-making for industry professionals.

Application

The CoreLogic Home Value Index is useful for any individual or organisation interested in:

Tracking changes in the value of a market portfolio containing all known properties (or any smaller portfolio) captured within CoreLogic’s property database due to market value changes (as opposed to changes in composition);

Measuring historical residential property risk and returns in a given suburb, region, or nationally over a particular period of time;

Forecasting future residential property returns or risks in a suburb, postcode, region, TA or nationally over a given period of time (e.g. months or years).

The CoreLogic Home Value Index can be leveraged by a range of industries and users:

- Mortgage lenders and brokers

- Insurers

- Real estate agencies

- Participants in the media and general public

- Central and Local Governments

- Universities and other tertiary education

- Economists and consultants

- Investment bankers

- Fund managers

- Super funds

- Listed property investors

- Property developers

- Building materials suppliers

- Existing or potential home owners & investors

- Policy makers

The CoreLogic Indices can be produced for various geographic demarcations

Produced across properties or divided between property types such as houses, flats/townhouses, apartments and lifestyle properties.

The CoreLogic Indices can be produced for various geographic demarcations

Produced across properties or divided between property types such as houses, flats/townhouses, apartments and lifestyle properties.

CoreLogic has deep expertise processing large quantities of data and is capable of producing a hedonic index that is a timely, more reliable measure of property value change through time, and which is not affected by changes in the composition of the property stock.

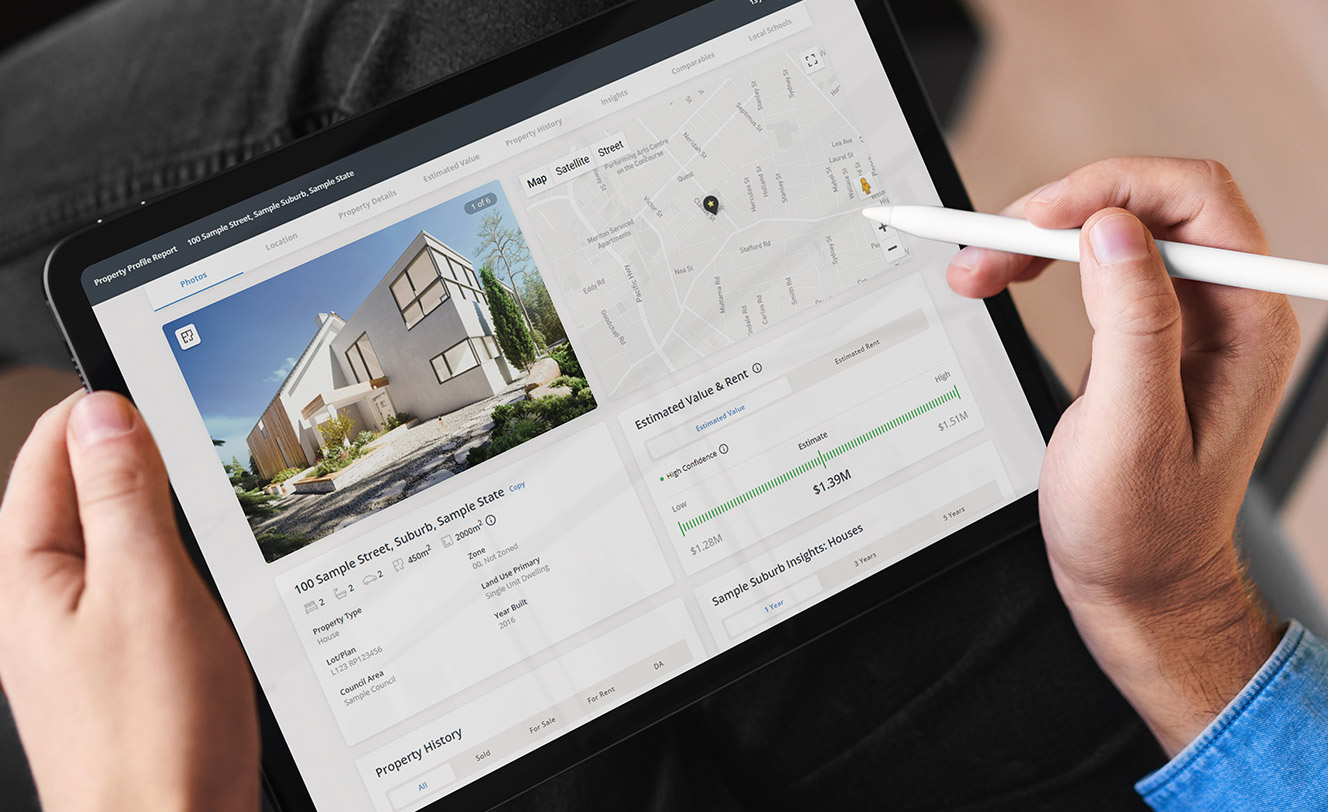

The CoreLogic Home Value Index is a hedonic model. This index utilises comprehensive information on the attributes and characteristics of residential properties (such as location, land size, and bedrooms) to measure “quality-adjusted” changes in property value over time and to also impute the value of dwellings having a certain set of characteristics (but no current sales price) by observing the sales prices and characteristics of other dwellings which have recently been observed as selling.

The hedonic method has the advantage that it utilises attribute (or characteristic) information of each dwelling to help mitigate biases that are otherwise prevalent in median and repeat sales property price indices. Another important advantage of a hedonic imputation index is that its calculation frequency can be weekly and that it tracks the value of an entire portfolio of property, not just the prices of properties observed to sell in a given period.

All of CoreLogic’s hedonic indices, as well as any other products based on the hedonic methodology, are revised each month for 12 months inclusive following the initial reported date. This revision ensures the longevity of the historical index values by incorporating all relevant transactions into historical figures as they become available. However, this doesn’t compromise on the ability of the index to measure market turning points in a timely fashion, given that recent agreed sales are also fully utilised.

The CoreLogic House Price Index is a SPAR (sales price appraisal ratio) index, meaning it applies the performance of recent sales to the entire base of properties in an area to measure how market movements have affected all properties. By calculating the average property value in each area, comparisons can be made with previous periods. It’s more reliable and reflective of property value change over time than measures that use sales prices in a given period, as the composition of properties which sell in a period can change dramatically, producing volatile and less-representative results.

The hedonic regression model is a method used to calculate the CoreLogic Home Value Index.

This methodology seeks to overcome the issue of compositional bias associated with median price and repeat sales measures. The premise for this lies in hedonic theory which says that the value of a composite good, such as a house, is the sum of its components. Thus, by separating the sample of houses into their various structural and locational attributes, the differences in these qualitative factors across houses can be controlled.

Hedonic imputation is a method of imputing the value of dwellings having a certain set of characteristics (but no current sales price) by observing the sales prices and characteristics of other dwellings that do have recent sales prices.

To learn more about the methodology used in the CoreLogic Home Value indices please refer to the following studies, which have been published in the interests of transparency:

Methodology FAQ

CoreLogic Home Value Index

|

City |

All Dwellings |

||

|---|---|---|---|

| Index value | % Change YoY | % Change MoM | |

Auckland = Rodney, North Shore, Waitakere, City, Manukau, Papakura, Franklin

Wellington = Porirua City, Upper Hutt City, Lower Hutt City, Wellington City

Monthly Movements

The Home Value Index aims to measure month to month movements in the value of New Zealand's housing markets. Rather than relying solely on transacted sale prices to provide a measure of housing market conditions, the CoreLogic Home Value Index is based on a 'hedonic'’' methodology which is trained on transacting properties, and then imputes a value for each observable property in an area. The imputed value considers the attributes of individual properties as part of the analysis.

Understanding factors such as the number of bedrooms and bathrooms, the land area and the geographic context of the property allows for a much more accurate analysis of true value movements across specific housing markets. This method also allows for compositional change in consumer buying patterns when measuring capital gains.

The Home Value Index provides monthly capital growth measurements across main housing types: detached houses, flats/townhouses, apartments, lifestyle properties and a combined dwellings index.

CoreLogic's hedonic indices, as well as other products based on the hedonic methodology, are revised each month for 12 months inclusive following the initial reported date. This revision ensures the longevity of the historical index values by incorporating all relevant transactions into historical figures as they become available.

Weekly Back Series

Time Series zoom: Click and drag in the graph space to view specific time series. You can also click on legend items to disable/enable.

Auckland = Rodney, North Shore, Waitakere, City, Manukau, Papakura, Franklin

Wellington = Porirua City, Upper Hutt City, Lower Hutt City, Wellington City

The graph traces the past 12 months of index values for each of the major cities and national dwelling markets. The graph is updated weekly and provides a rolling 52 week view of how dwelling values have changed based on the CoreLogic Weekly Home Value Index.

The weekly back series will revise for the past 12 months in line with the revision across all of CoreLogic’s Hedonic Indices.