Overview

CoreLogic’s PropertyHub makes it easy to research properties, order valuations and track their progress in a single platform. Over 30,000 lenders, advisors and other mortgage professionals across New Zealand and Australia use this industry-leading tool to support customers on their home ownership journeys.

Trusted, timely and detailed property data

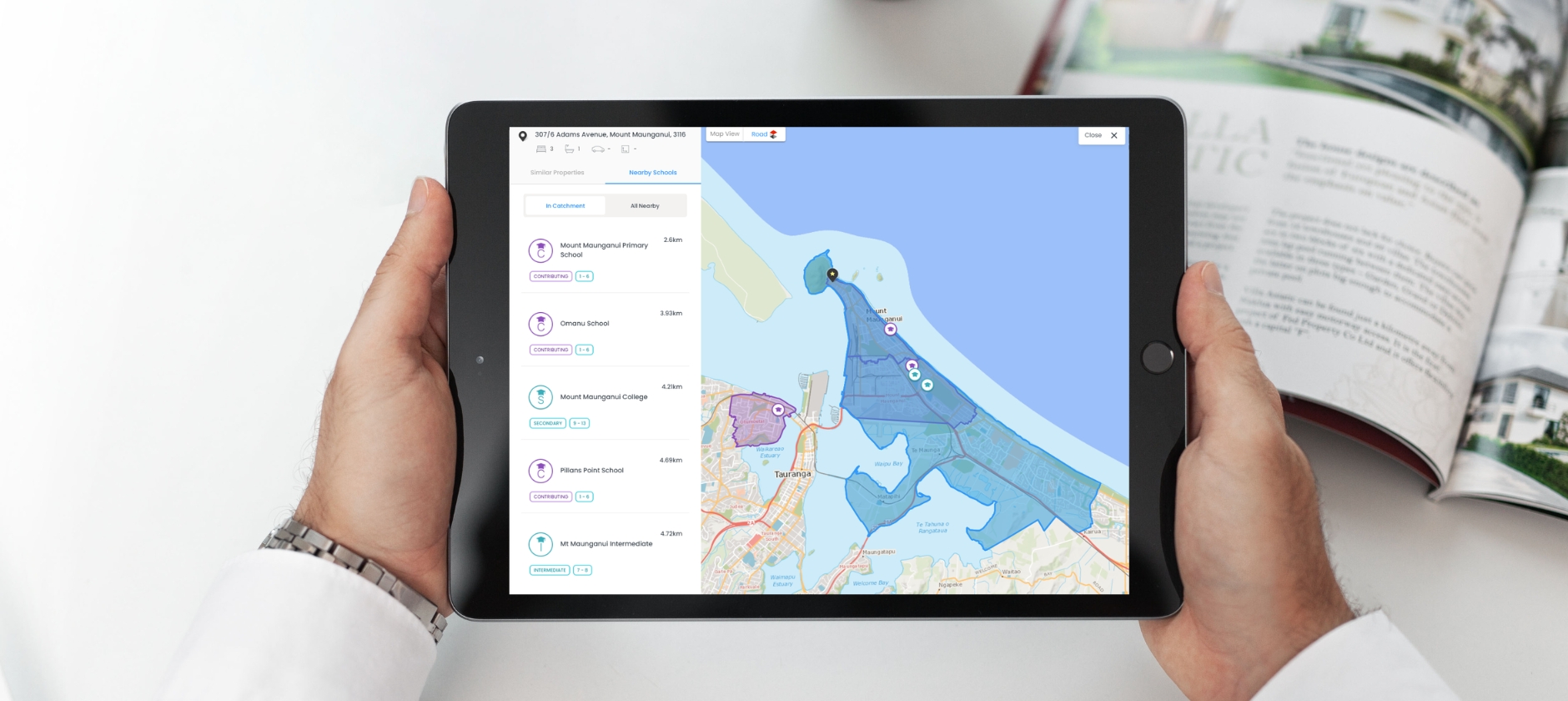

By integrating with PropertyHub, lenders and advisors can access property data and analytics used and trusted by real estate professionals. With PropertyHub’s intuitive research tools, you can focus on the home purchasing journey – not just the mortgage – and help create a better experience for your customers.

Trusted, timely and detailed property data

By integrating with PropertyHub, lenders and advisors can access property data and analytics used and trusted by real estate professionals. With PropertyHub’s intuitive research tools, you can focus on the home purchasing journey – not just the mortgage – and help create a better experience for your customers.

Dashboards and alerts keep you informed as valuations progress through each phase of the workflow.

Delight your customers with informative Digital Property Reports and title reports.

With a Property Guru subscription you will unlock research capabilities in the PropertyHub platform to boost your market knowledge and help improve customer interactions.

Unlock intelligent business reporting

With access to PropertyHub, lenders can choose to monitor valuation conversion performance and lender behaviours. You can also use CoreLogic Business Intelligence Reporting services to access valuable benchmark reporting data and other CoreLogic valuation services.

Unlock intelligent business reporting

With access to PropertyHub, lenders can choose to monitor valuation conversion performance and lender behaviours. You can also use CoreLogic Business Intelligence Reporting services to access valuable benchmark reporting data and other CoreLogic valuation services.

Review valuation volumes by channel, user or service type.

Track conversion rates from upfront valuation to loan application.

Track valuation activity at a user level.

Activate layered user permissions to keep your data safe.

Manage valuation risk across your portfolio

PropertyHub can be adapted to suit your business – for instance, by building a rules engine that matches your business needs and risk profile.

Manage valuation risk across your portfolio

PropertyHub can be adapted to suit your business – for instance, by building a rules engine that matches your business needs and risk profile.

Mitigate valuation risk between your loan book and preferred valuation type.

Create your own valuation business rules around loan and property attributes in line with your risk appetite.

Understand conversion funnel performance across your business rules.

Latest news and research

More News & Research

Business as usual for cash rate and housing market

Chief Property Economist Kelvin Davidson unpacks the latest OCR decision and what it means for the housing market.

How can we help you?

Let's get this conversation started! Our team is here to provide you with more information and answer any questions you may have.